USDA Hogs and Pigs Report will be released Friday, as will the cold storage report. USDA will report November livestock slaughter on Thursday.

This coming Friday afternoon USDA will release their quarterly Hogs and Pigs report. For what it’s worth, my prediction is that USDA will say the market hog inventory is up 2.2% from a year ago and the breeding herd is 1.3% larger than a year ago. I’m guessing fall farrowings were up 0.9% year-over-year and that the number of litters this winter will be up 1.4% and spring farrowings will be up 1.9%.

If as expected, the herd is larger than a year ago, it will be the fourth consecutive December report to say so. That is an unusually long stretch for herd growth. It is likely for two reasons — increased slaughter capacity creates a demand for more hogs and most hog producers made money this year. Profits drive growth.

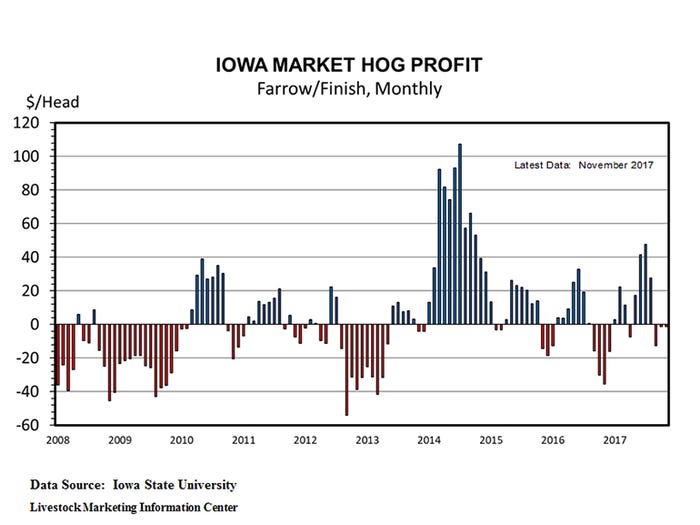

Calculations by Lee Schulz at Iowa State University put the average loss for Iowa market hogs sold in November at $1.38 per head for farrow-to-finish operations. November was the third consecutive unprofitable month. Given current hog prices, it looks like December will have a similar outcome. The ISU calculations had 2016 losses at $1.26 per head marketed. It looks like 2017 will average a profit of about $12 per head.

The December Hogs and Pigs report is likely to make several revisions to the September hog inventory report. Despite record slaughter levels, fall hog slaughter was lower than implied by the September market hog inventory. According to the September survey, the 180 pounds and up market hog inventory was up 3.9% on Sept. 1. Actual slaughter of U.S. raised barrows and gilts in September and early October was up 3.3%, a fairly small miss. USDA says the 120-179 pounds inventory was also up 3.9% on Sept. 1. Slaughter during the appropriate weeks of October and November was only 1.0% above last year. This shortfall in slaughter means USDA is likely to revise downward their estimate of the number of sows farrowed last spring and the size of the pig crop in March-May. The September report said the 50-119 pounds market hog group was up 1.8% on Sept. 1. We are half way through the corresponding slaughter period and hog slaughter has been up 1.8%.

Pork demand has been strong in recent months. Domestic pork demand was above the year-ago level each month from July through October. Export demand for U.S. pork has been above the year-ago level each month from November 2016 through October. November demand data won’t be available until November export data is released in early January.

USDA’s World Agriculture Outlook Board has decreased their estimate of U.S. pork production by 180 million pounds (0.7%) for 2017 and by 10 million pounds for 2018. They increased their forecast of live hog prices by $1.37 per hundredweight (2.8%) for 2017 and $2.50 per hundredweight for 2018. They are now predicting 2018 live hog prices will average roughly $1-$4 per hundredweight lower than this year

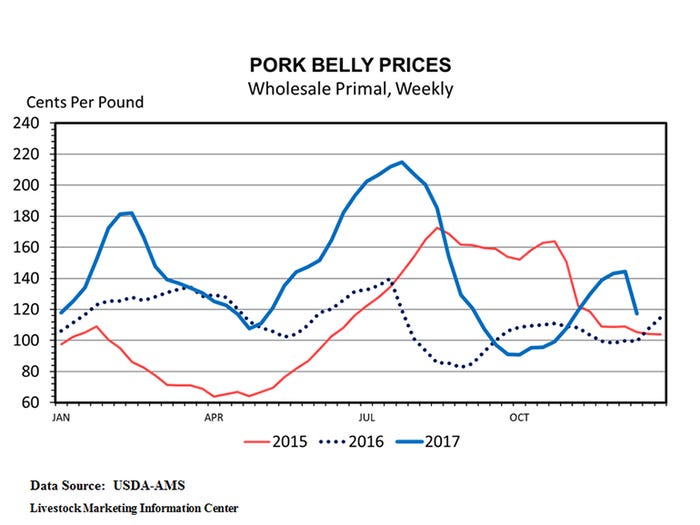

Pork belly prices took a big drop last week. The Friday afternoon pork belly primal price FOB slaughter plants averaged $109.37 per hundredweight, down $33.15 (23.3%) from seven days earlier. The ham primal was down 13.6% in value this week. Overall pork cutout value was down 7.4% for the week.

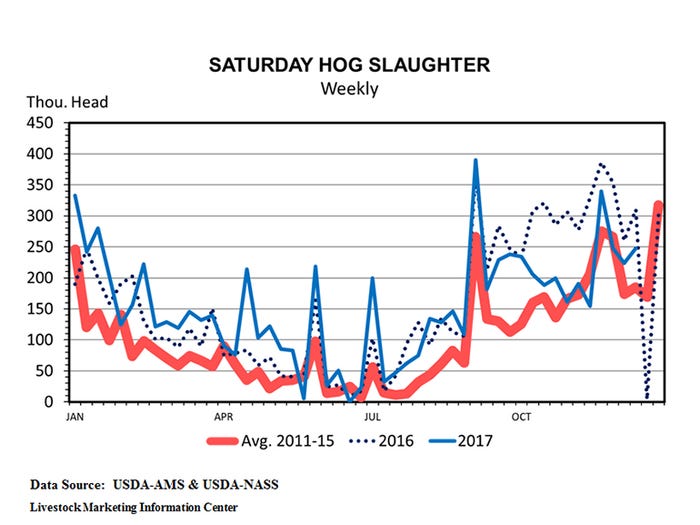

Packer slaughter capacity continues to climb. Hog slaughter totaled 469,181 head on Dec. 1, a new daily record breaking the old record of 468,132 set on Nov. 14. There has been a new daily hog slaughter record set seven times since Labor Day.

Last week’s hog slaughter was estimated at 2.578 million head, a new weekly record. Hog slaughter totaled 2.55 million for the week ending on Dec. 2, which broke the old record of 2.54 million set 52 weeks earlier on Dec. 3, 2016.

Slaughter capacity has clearly increased more in the past year than the hog herd. Over the last 10 weeks hog slaughter has been 1.3% higher than a year ago, but Saturday slaughter is down 31% compared to the same 10 Saturdays last year. The big drop in Saturday kill indicates packers are able to handle a larger share of the hog run without having to operate on the weekend, which is one reason fall hog prices have been higher than a year ago.

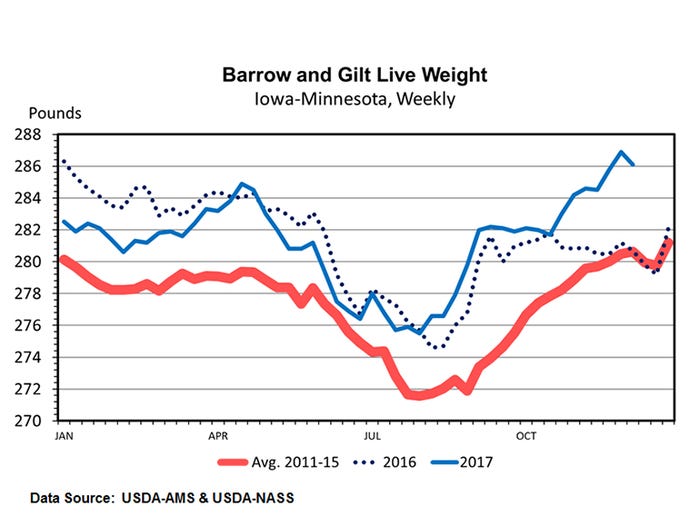

Whether it’s because of cooler weather, new corn, or both, slaughter weights always increase in the fall. Over the last six weeks, Iowa-Minnesota live slaughter weights have averaged 285.4 pounds. That is 4.6 pounds heavier than a year ago. Have hogs grown especially fast this fall or have producers delayed marketings? The trend is weights since August has been in line with the 2011-15 average. It’s weights in November and December of 2016 that were out of line.

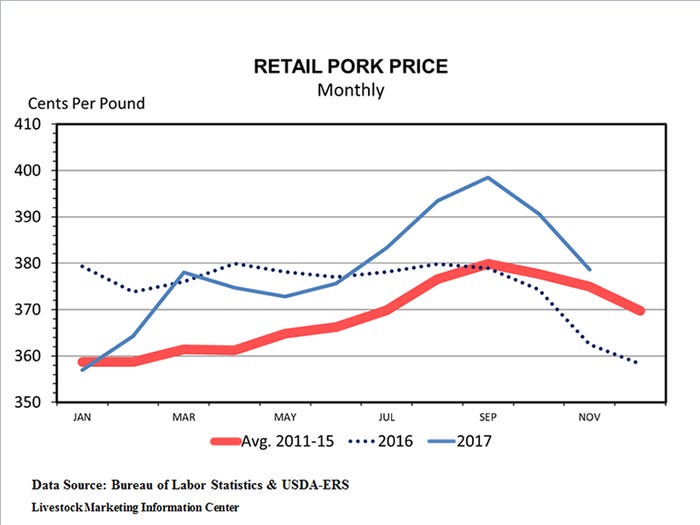

Retail pork prices averaged $3.786 per pound in November. That was down 12.1 cents from the month before, but up 16.1 cents from November 2016. Both the packers’ price spread and the retailers’ price spread were smaller than last November. Higher retail pork prices and tighter marketing margins allowed November live hog prices to be $12 per hundredweight higher than a year ago. Retail pork prices are quite likely to be lower again this month. The December average retail pork price has been lower than November’s average every year since 2009.

Thursday afternoon USDA will report livestock slaughter data for November. Preliminary data indicates commercial hog slaughter in November was down 0.4% compared to 12 months earlier. That is roughly 3.5% below the level implied by the September quarterly inventory survey.

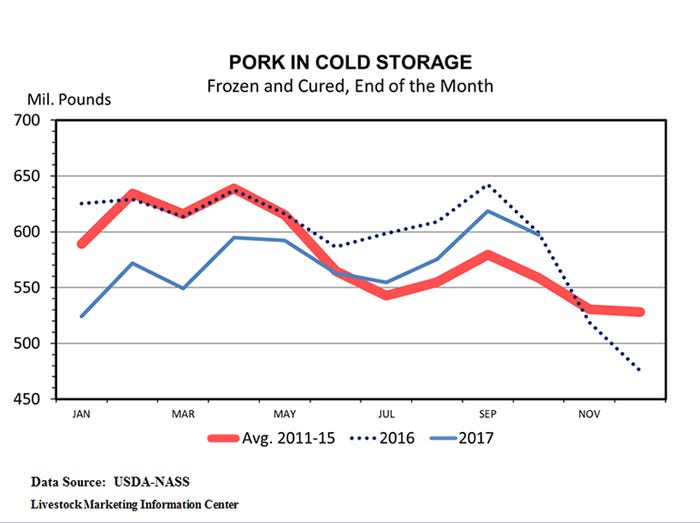

On Friday afternoon USDA will release data on cold storage stocks on the last day of November. Stocks of frozen pork have been below the year-ago level each of the last 21 months. Don’t be surprised if that streak has ended.

About the Author(s)

You May Also Like