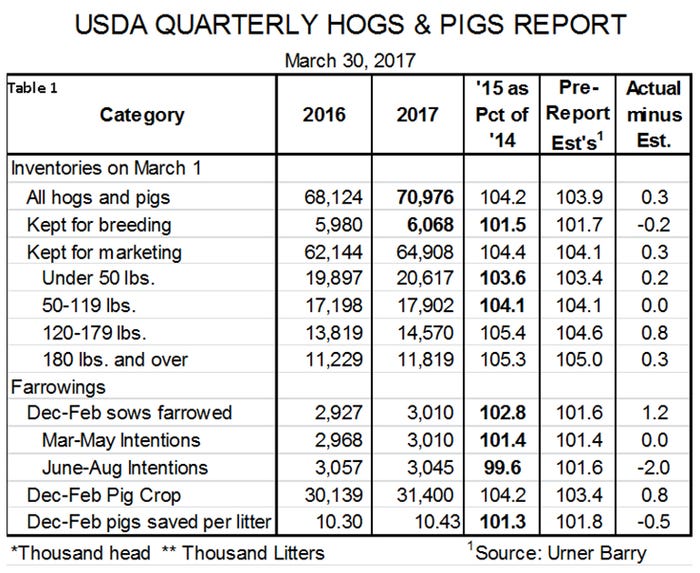

Breeding herd is still growing, but not at a dramatic clip. The 1.5% year-on-year increase was slightly below the average pre-report estimate, and the March 1 herd was smaller than the Dec. 1 herd for only the second time in the past seven years.

April 3, 2017

USDA’s quarterly Hogs and Pigs report, released last Thursday, says the U.S. pork sector is still growing but at a slightly slower clip than was indicated by the December report. USDA’s actual inventory numbers were very close to the averages of analysts’ pre-report estimates, leading to little impact on CME Lean Hogs futures on Friday. The key numbers from the report appear in Table 1.

National Hog Farmer’s Cheryl Day summarized much of the report and the reactions of three noted market analysts in her column in Friday’s e-edition.

Analysts’ observations were all spot-on, but let’s consider some more details.

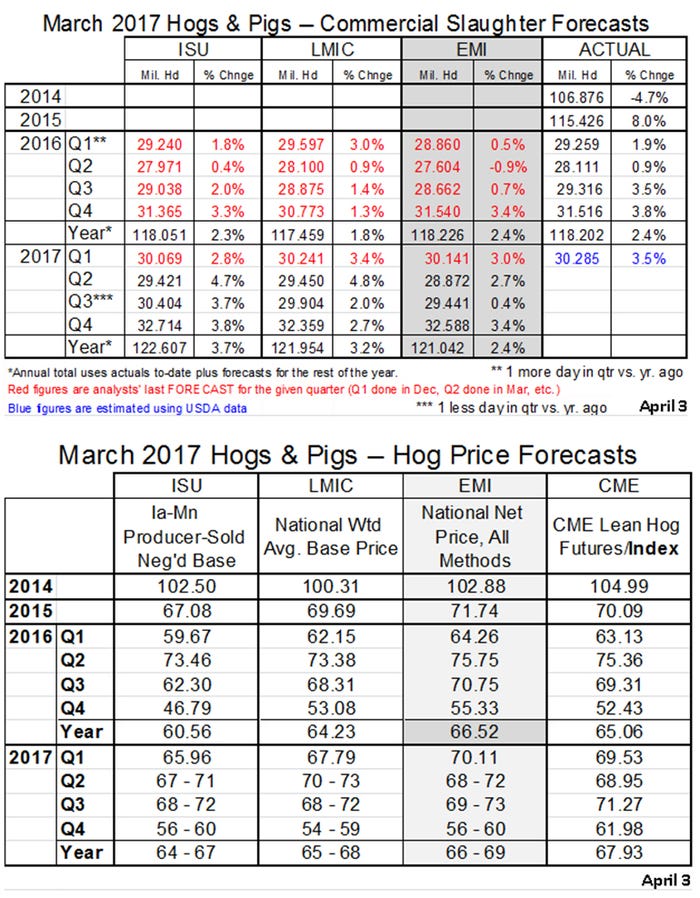

• The market inventories shown here, growth of the breeding herd and growth of key productivity measure all mean that we will see new records for slaughter and production in 2017. The hog buying activity caused by new packing plants will offset most of the negative impact of these supplies, but that help will not come until the fourth quarter.

• The breeding herd is still growing at a healthy but not at a dramatic clip. But is it right? The 1.5% year-on-year increase was slightly below the average pre-report estimate and about precisely in line with our forecasts. But the March 1 herd was smaller than the Dec. 1 herd for only the second time (the first was last year) in the past seven years and the inventory in Oklahoma is, according to USDA, 35,000 head smaller than one year ago. My contacts in that part of the country have no idea where those sows may have gone and the inventory date for this report is March 1, several weeks before fire destroyed two large sow complexes in Oklahoma.

• Productivity is surging again. Note the 2.8% growth in December-to-February farrowings relative to a 1.5% increase in the breeding herd. The 1.3% increase in pigs saved per litter (i.e. litter size) is actually a bit slower than the growth rate of the last few years but the two numbers imply that the pig crop would grow by over 4%, right in line with USDA’s estimate for December to February.

• USDA revised the June-to-August pig crop upward 1.2% in light of winter slaughter. That continues a pattern of revising pig crops upward two quarters hence but this revision was only half as large as the average of the past three years.

My criticism of the USDA’s pig inventory estimates over the past few years is pretty well known. I still believe the December report was, to a great degree, a “recalibration” by the USDA and it appears that, with its large positive year-on-year figures, this report is a continuation of that process. If so, we would expect to see pig crop revisions continue to get smaller as the USDA’s initial estimates get closer to the actual numbers of hogs that appear in slaughter totals six months hence. We congratulate USDA’s team on this effort. Accurate estimates are very important.

The report puts the onus for economic success this year squarely on demand. USDA is currently forecasting exports to grow by 8.4% this year. That is the most aggressive forecast of which I am aware. I have exports up 5% and it will be almost imperative for them to grow by that much given these hog supplies.

Our forecast for slaughter growth is lowered from plus-2.7% to plus-2.3%. Our production forecast is plus-2.9% and that will put total domestic availability/disappearance/consumption at plus-2.4%. Per capita availability/disappearance/consumption will be 50.9 pounds retail weight, up 1.7% from last year and the largest since 2004.

No one is forced to eat pork but production, imports and exports leave us an amount of pork that must “disappear” somehow. The question is whether consumer level demand will be strong enough to get that product purchased and consumed at prices that, in the long run, will support high enough wholesale and hog prices for packers and producers to make money. Given cost levels, it appears that will be the case this year — but not by much. Corn, soybean meal and hog futures as of April 3 imply and average profit of just $1 per head for 2017.

Note that we have changed the hog price that we forecast from the “National Net Negotiated” to the “National Net All Methods”. The negotiated price represented only 2.4% of all hogs sold in 2016. It still represents the value of the “marginal” pig but it is such a small percentage that there are times that it does not represent what we believe to be the “hog” market. Forecasts for the second quarter and the third quarter were raised by $2 to $4 per hundredweight based on this report. Increased demand from new packing plants is the primary reason that 2017 prices do not reflect the full negative impact of forecast supply increases.

About the Author(s)

You May Also Like