Friday's quarterly Hogs and Pigs report is eagerly anticipated by market analysts, and some weigh-in with pre-report estimates that the breeding herd and market hog inventory are both up from a year ago.

USDA’s quarterly Hogs and Pigs report will be released at 11 a.m. central time Dec. 23. The report is always eagerly anticipated by hog market analysts because it has a good track record of revealing the future level of hog production.

A pre-report survey conducted by Bloomberg News indicates market forecasters think the Dec. 1 hog inventory was up 2.0% compared to a year ago. These “experts” say the breeding herd was 0.3% larger than a year ago and the market hog inventory was up 2.1% compared to Dec. 1, 2015.

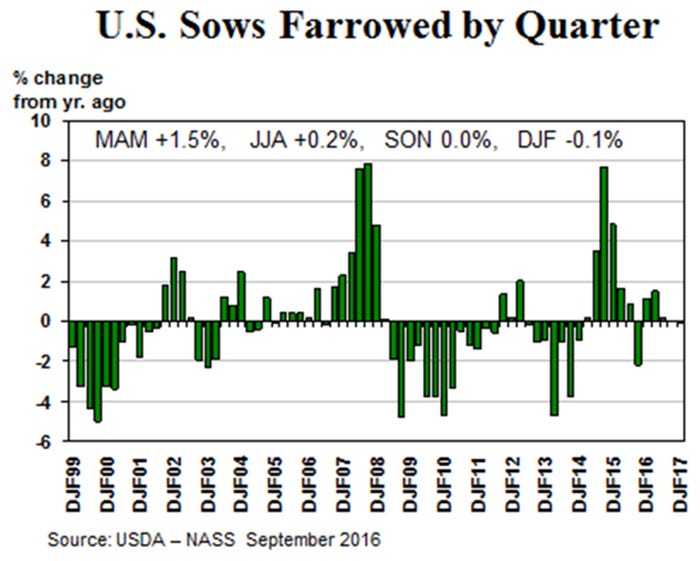

USDA’s September Hogs and Pigs report predicted fall (September to November) farrowings would be even with last year and winter (December to February) farrowings would be down 0.1% compared to a year ago.

The respondents to the December pre-report industry survey think USDA will now say fall farrowings were up 0.3% year-over-year. The forecasters expect USDA to predict winter farrowings will be down 0.4% and spring (March to May) farrowings will be unchanged from a year ago.

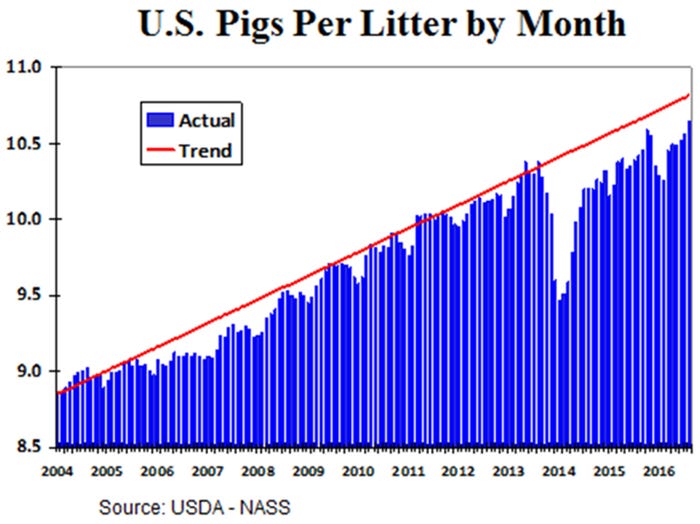

The trend in the number of pigs per litter is for an annual increase of roughly 1%. Thus, if these forecasts of farrowing intentions are correct, the winter pig crop is likely to be up about 0.6% and the spring pig crop up 1% or so.

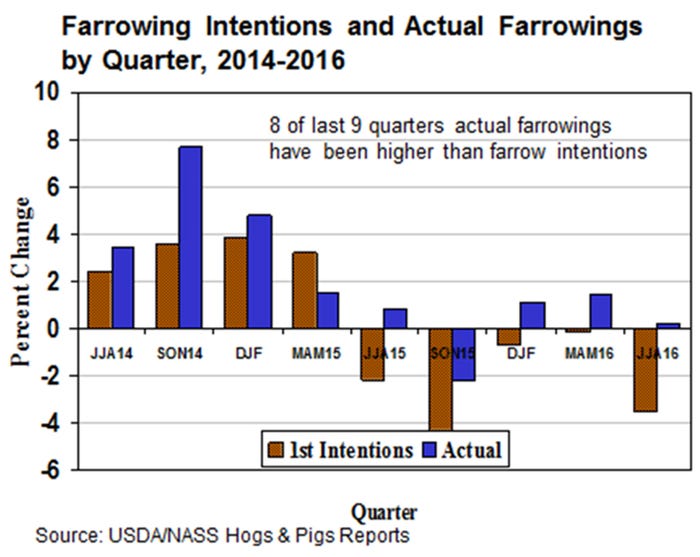

Farrowing intentions in the quarterly Hogs and Pigs report have been less accurate than normal during the last two years. Eight of the last nine quarters, the number of sows farrowed has been higher than the farrowing intentions predicted. A likely reason is that producers have recovered from the devastating impact of the porcine epidemic diarrhea virus faster than was expected.

This streak of under-predicting farrowings may continue a bit longer as the pre-report survey indicates the experts think fall 2016 farrowings were up 0.3% year-over-year. The September Hogs and Pigs report had predicted fall farrowings would be even with the year before.

The trade forecasters estimated pigs per litter during September-to-November were up 1.3% year-over-year to a record 10.67 pigs per litter. When combined with 0.3% more litters farrowed, this yields a fall pig crop that is 1.6% larger than a year earlier. This implies that spring (March to May) 2017 hog slaughter should be roughly 1.6% higher than in 2016. But, the experts say the inventory of market hogs weighing less than 120 pounds on Dec. 1 was up 1.9% implying a slightly higher March-to-May slaughter.

The average of the expert predictions for the market hog inventory in the pre-release survey is 2.1% higher on Dec. 1 than a year earlier. Their forecasted breakdown of market hogs by weight group is: 180 pounds and over up 2.9%; 120-179 pounds up 2.0%; 50-119 pounds up 1.8%; and market hogs weighing 50 pounds or less up 1.9%.

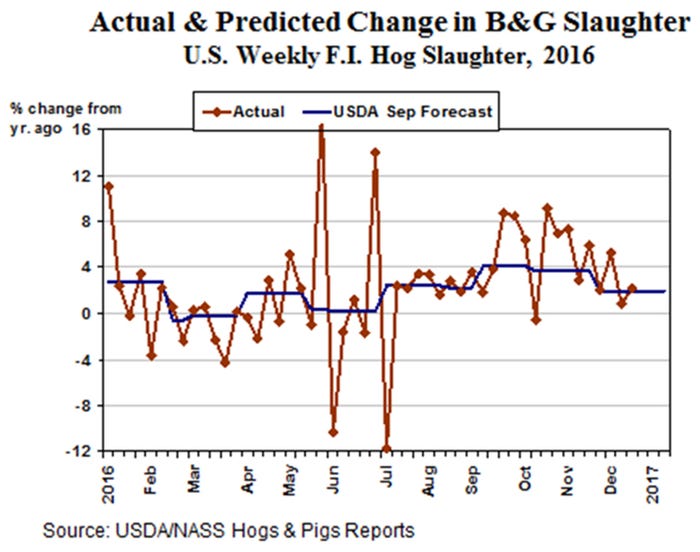

The first check on the accuracy of USDA’s quarterly hog survey numbers is the match (or lack thereof) between the 180 pound and over market hog inventory group and hog slaughter since the first of the month. If the 180 pound plus market inventory actually was up 2.9% year-over-year on Dec. 1, then barrow and gilt slaughter during the first five weeks after Dec. 1 should also be up 2.9%.

If the pre-report trade estimates are right, then the breeding herd was 2,000 head larger at the start of December than on Sept. 1. In 2015 the breeding herd was 16,000 head larger at the start of December than on Sept. 1. The much slower breeding herd growth this year is reasonable given the larger herd and the lower producer profits this year.

U.S. sow slaughter during September to November was up 30,000 sows or 4.3% compared to a year earlier. Imported sows for slaughter were up 1,130 sows or 1.1%. Thus, net slaughter of U.S. sows was up 28,900 or 4.8%. Given 28,900 more sows slaughtered, no change in on-farm death loss, and a 2,000-head increase in the breeding herd, then the number of gilts added to the breeding herd during September to November was 30,900 more than a year ago.

A number of revisions to earlier estimates are likely to be made in Friday’s report.

Slaughter of barrows and gilts during the 13 weeks of fall was up 1,401,570 head (4.88%) compared to a year ago. The number of barrows and gilts imported for slaughter from Canada during this period was down 77,768 head. This means slaughter of U.S. raised barrows and gilts was up by 1,479,338 head. That is 5.18% more than a year ago and 1.57% (448,000 head) more than implied by the September Hogs and Pigs report. Therefore, in Friday’s report USDA is likely to revise upward their Sept. 1 market hog inventory, the spring (March to May) pig crop and the number of litters farrowed. Look for the March-to-May pig crop to be increased by about 1.5%. Since USDA rarely revises their estimate of pigs per litter, look for March-to-May farrowings to also be increased by 1.5%. USDA is also likely to increase lightweight market hog inventory in the June estimate and the heavy weight inventory in their September estimate.

What does it all mean? If the trade forecasts are right, then 2017 hog production will be record high for the second year in a row. If trends continue on pigs per litter and hog imports from Canada, then the pre-report survey implies first quarter hog slaughter should be up about 2.0%, second quarter up 1.6%, and third quarter up 0.8%. For the fourth quarter of 2017 I’m going with a forecast of a 1.1% increase in hog slaughter. For all of 2017, hog slaughter is likely to be up about 1.4%.

Given all the red ink in recent months, increased hog slaughter in 2017 may seem unlikely. But, the construction of two new slaughter plants makes this a reasonable possibility.

About the Author(s)

You May Also Like