March 26, 2012

Last week’s Cold Storage report is causing a degree of concern in the pork industry. February 29 stocks of frozen pork cuts were significantly higher than last year. A total of 624.7 million pounds of pork were in freezers at the end of last month – 8.8% larger than last month and 6.7% higher than last year. It is also the largest freezer inventory for pork figure since April 2008.

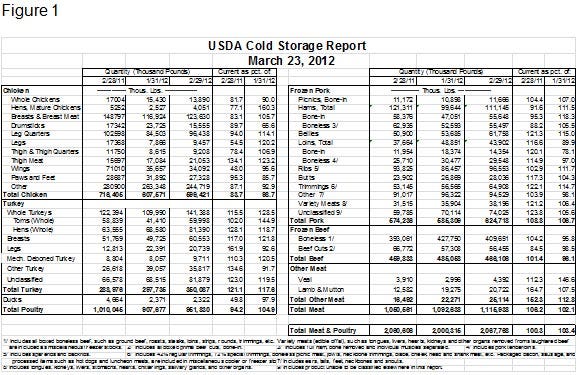

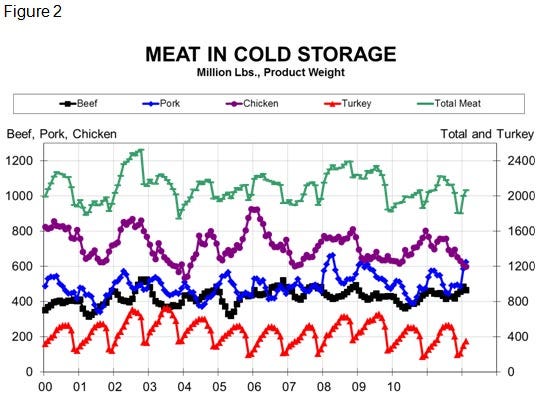

Total frozen meat and poultry stocks of 2.068 billion pounds are virtually equal to February 2011 inventories and 3.4% higher than last month. However, they are still below the mid-range of the level of frozen meat and poultry stocks since 2000, so I am not concerned with the overall weight these stocks may put on the protein market in the short run.

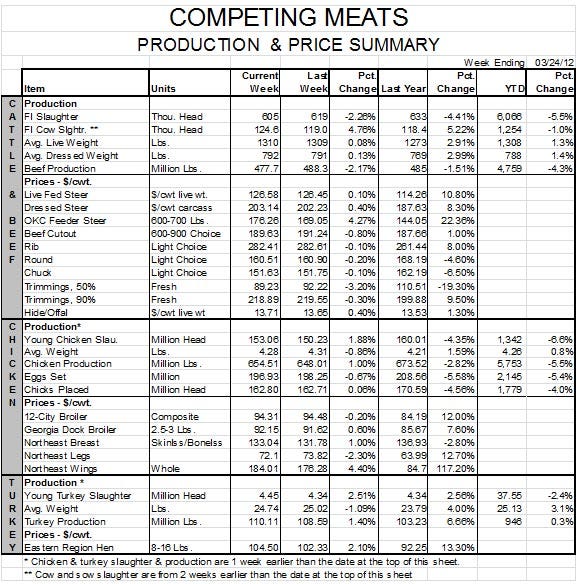

Total chicken inventories continue to decline and dropped below 600 million pounds for the first time since early 2004. Frozen chicken stocks were 16% lower than last year and 1.3% lower than last month. Dramatic reductions in output are finally tightening chicken supplies enough to see positive price implications, even for breast meat.

Beef inventories dropped nearly 4% during February as cattle slaughter rates slowed. The 466.1 million pounds of beef in freezers was still 1.4% higher than last year, but certainly not burdensome to the market.

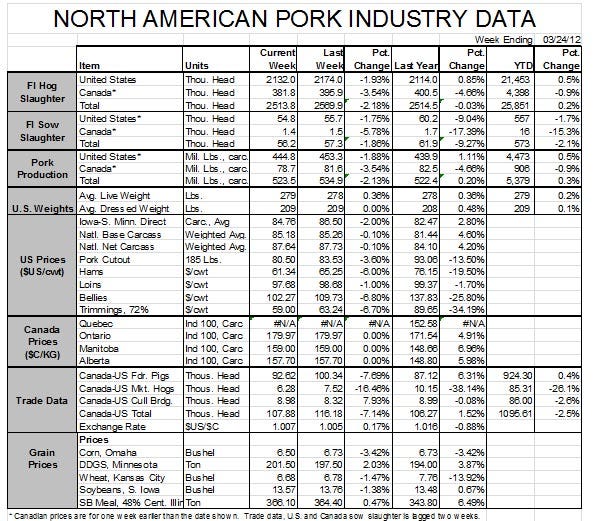

As Figure 1 shows, pork was the driver of the February increase in total meat and poultry inventories and the increases were virtually across the board. The table shows that stocks of every cut except hams were higher this year vs. February 2011, and that stocks of every cut except loins and “other” pork grew during February.

Don’t Sound the Alarm Just Yet

So should we be alarmed about this increase in frozen pork inventories? I don’t think so – at least for now. There are three reasons I’m not too worried and far from panic stage.

1. The March Cold Storage report (end-of-February stocks) is usually at or near the high for the year. If that is the case this year, the 181.815 million- pound increase from the August report (July 31 inventories) will be quite reasonable. Compare that to an increase of 186 million pounds from July 31, 2010 to Feb. 28, 2011 and 208 million pounds from the summer of 2007 to March 2008.

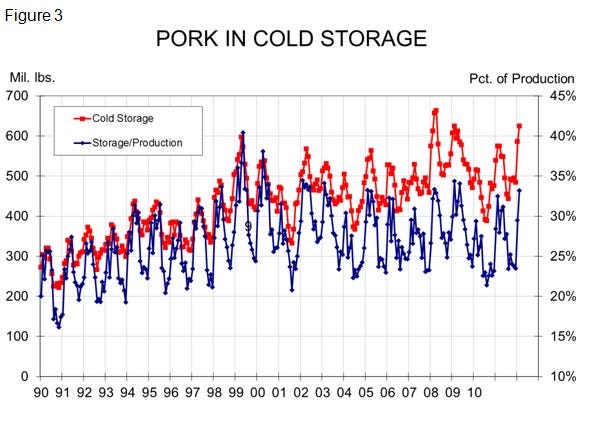

2. Cold storage inventories as a percentage of production are not out of line at all for this time of year. As Figure 3 shows, February stocks amounted to just over 33% of February pork production. The February level is usually at or near the annual high and a figure from 32 to 34% is very typical.

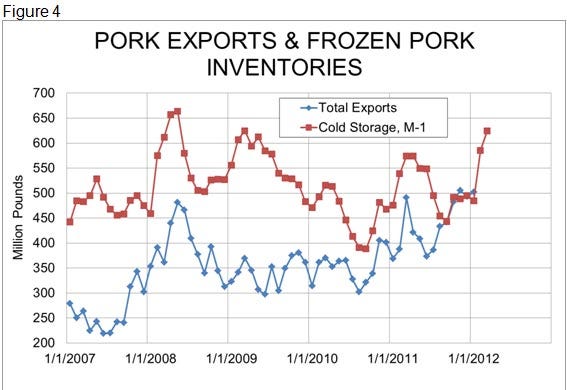

3. Higher freezer inventories are one symptom of higher exports. University of Missouri Agricultural Economist Ron Plain made this point very well in an article published over the weekend and his argument is borne out by Figure 4. Note that I have offset the export and cold storage data by one month in this graph. The first observation for 2012 represents Dec. 31, 2011 cold storage stocks and January 2012 exports. That is a much better matching of the data according to real-world practices. What is important about Figure 4 is the historical relationship between cold storage stocks and exports. It is pretty obvious that U.S. exporters put product in freezers in anticipation of significant export shipments. It clearly happened in 2008 and 2011. Freezing product in anticipation of exports did not work out in 2009, but we think H1N1 virus-driven export disruptions that began in April played a significant role in that. We won’t know for a couple of months whether the January and February freezer stock increases supported another wave of exports but it is very possible.

I don’t mean to minimize the data, and I am concerned about the frozen pork stock increases, but there could be very good reasons for the increases.

COOL Rules Challenged

Another noteworthy development this week was the announcement that the United States will indeed appeal the World Trade Organization’s (WTO) ruling against our mandatory country-of-origin labeling (COOL) law. That ruling came down last summer and started the clock ticking for the United States to either change its requirements or face retaliatory action by Canada, Mexico and other countries deemed harmed by COOL.

It is almost standard operating procedure for the U.S. government to appeal negative WTO decisions, so this is no surprise. But I don’t know of anyone who really thinks it will work. The filing, however, does buy time for government officials to figure out what to do.

A number of officials have asked industry groups to suggest ways to tweak the COOL rules to meet WTO demands. That’s a good idea, but no one I’ve talked to thinks the rules can be changed that much and still be in line with the actual COOL legislation. That means Congress must change the law, and they are horribly distracted with things like presidential campaigns, budgets, campaign fundraising, deficits, reelection campaigns, etc. With such pressing concerns, delay tactics are probably good. We wouldn’t want real work to get in the way of all of those campaigns now, would we?

About the Author(s)

You May Also Like