May 27, 2014

When it comes to market dynamics, 2014 has been a very interesting year for the swine industry. We have seen record- high cash hog prices while at the same time, producers have been dealing with porcine epidemic diarrhea virus (PEDV). Practicing sound risk management has been key as the industry navigates through an environment with historic margin calls as well. It’s also worth noting that swine producers are receiving over $225 for their hogs, but some are still unhappy because production is not as good as it has been in the past, causing them to lock up margins too early and requiring them to pay margin calls. We have also seen our operating lines drop from a peak volume of over $1 billion to $600 million, which is a drop of 40% in less than 60 days. These are interesting times.

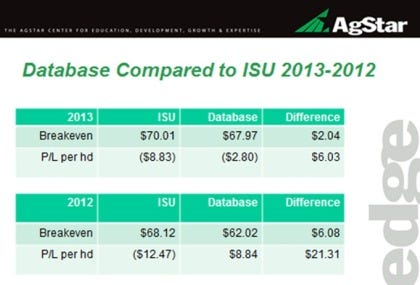

I have stressed to many producers, and I’ll say it again: everything is relative. The swine industry will make money this year despite poorer production (remember 2006-2007 and the porcine circovirus?). Another advantage of practicing sound risk management, as compared to producers selling pigs on the open market, is that they have outperformed the industry average for the past two years by more than $12 per head (see table). It’s a “given” that 2014 will look quite different, but I want to remind everyone what this industry went through in 2008-09. The industry changed and producers who did not practice any form of risk management went out of business. Today, more and more producers are comfortable with locking up profits, knowing they are going to make money. They’ve left the stress and worry of being on the open market behind. Instead of hoping that they will be profitable, through margin management, they know they will be profitable.

Options vs. Straight Futures?

We are so fortunate to have very good relationships with our clients. Many of our recent discussions with them have focused on the use of options as opposed to a straight futures position. The margin calls over the last four months have had many producers exploring this strategy. I don’t have a preference for one over the other, and I tell clients we support both strategies. What I stress to clients most of all is how vital it is to understand cost of production. You also need to understand that there are variables impacting your overall margin.

Basis on cash hog sales as well as what you used for basis on grain will effect what you actually receive for a profit. This is always a moving target and, again, not always an exact science. The key point we try to stress is taking advantage of an opportunity for locking up profits when they are available and utilizing a strategy that incorporates what you believe your bias is. What I mean by that is whether or not you are bullish on what the hog market might be doing going forward (option strategy might make sense if that is your bias) or if you are bearish (a straight futures position might make more sense if that is your bias). I would suggest communicating with your market advisor to determine which strategy best fits your operation.

Upcoming Webinar with Brett Stuart

We are hosting a webinar with Brett Stuart with Global Agritrends on Wed., May 28, at 1:30 p.m. Here is the link to sign up if you have interest: http://pages.agstar.com/porkupdate_apr2014.html . You can actually sign up for the webinar and if this time frame does not work for you, we will send the recording and slides so you can listen to the webinar at a time that is convenient for you.

Staying Engaged on Advocacy

I spend time on the weekends and early in the morning reading articles concerning the swine industry and agriculture. It seems that many in the media portray our industry in a negative light and we need to continue to stay engaged in telling our story. Our marketing department at AgStar pushed me to be active on Twitter and I am. Social media, such as Twitter and Facebook is a way to tell our story. I try using twitter to reach out and tell our story and others do as well. We need more of you to engage in the discussion. If you have a twitter account and wish to follow me, please do at @AgStarAgGuy. We can no longer afford to stay on the sidelines.

Mark Greenwood is the Senior Vice President for Relationship Management at AgStar. He is responsible for overseeing the industry expert group consisting of consulting, large grain, dairy, renewable fuels and the swine industry. He has been with AgStar since 1997. For more insights from Mark and the AgStar Swine Team, including their weekly video Hog Blog, visit AgStarEdge.com.

You May Also Like