At some point the good news is going to run its course. At this time all worries will have been set aside and everyone will be bullish. This is when tops in the market are formed.

January 22, 2018

At one point recently we’d experienced several downward revisions in the daily hog slaughter, weights were running as much as five pounds higher than the previous year, and we were expecting confirmation of widespread expansion on the upcoming Hogs and Pigs Report. In addition, reports surfaced regarding a shortage of reefer trailers and truck drivers for shipping product and production was projected to be record large in 2018, topping record large production in 2017. All of this is occurring in the face of a possible meltdown in the North American Free Trade Agreement. Nothing to worry about, right?

Thus far the lean hog futures market has seemingly ignored all of the above concerns, instead, solely focused on demand. Over a year ago I published a column discussing the packer expansion in the hog pork industry and stated that millions of dollars would not be invested in new processing plants without real knowledge that demand would be there to absorb the new production. After that column was published I was confronted with several challengers indicating I was giving way too much credit to the newly formed packers and their ability to measure and read demand coming down the pipe. I don’t think so. The industry is right on track as demand for U.S. pork, both domestically and in the export arena, has never been stronger.

Indeed, the moderate expansion confirmed on the recent Hogs and Pigs Report did nothing to shutter the up tend in lean hog futures. Warning signs to an old fundamental guy like me that hogs are being backed up — signs like consistent downward revisions in the kill in tandem with rising weights — have not stemmed the tide of buyers entering the market. Even serious talk coming out of Canada that the United States would soon pull out of NAFTA did not phase the market.

Looking at the product, specifically, the butts have seen support during January off exceptional demand from South Korea ahead of the winter Olympics. Hams, with Easter coming early this year, are already experiencing Easter bookings. Bellies remain on fire as the demand for bacon just does not quit.

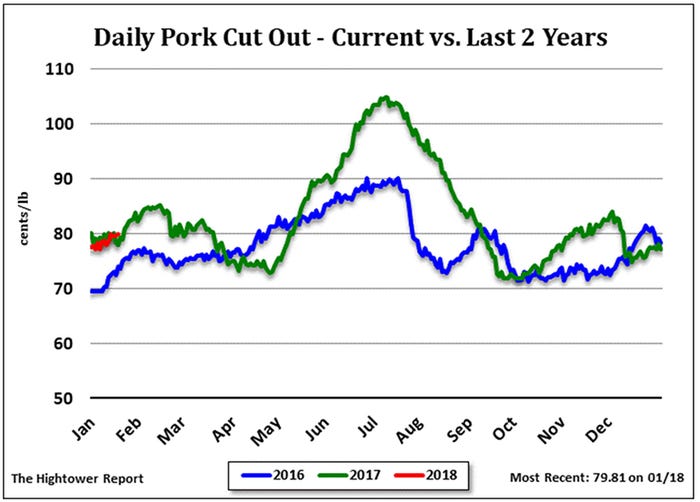

Loins, perhaps, have been the soft spot but they’ve traded sideways for most of the winter and certainly have not caused much drag on the pork carcass. When looking at the graph of the pork cutout value it’s amazing that cutout values are nearly identical with year-ago values despite substantially larger production. Of course this is a direct function of higher demand or a shift in the demand curve for pork. The seasonal tendency would suggest that cutout values could edge lower into early April before embarking on a huge and substantial rally during the spring and summer. Will the decline into early April actually occur this year?

While I continue to worry the market continues to rise with the uptrend in futures well intact. From a seasonal standpoint traders and hedgers should have a couple of important timeframes in mind. The first would be the next seasonal high which is due in early February. This would be followed by another seasonal low in mid-February followed by a more important seasonal high in early March. The high timing in early March is when traders, especially hedgers, may want to establish some serious hedges in the summer and fall timeframe. Finally, the major summer high will be due from the middle of June until around the Fourth of July. If demand stays strong into this period and weights drop off in tandem with lower seasonality in hog numbers, this rally should be looked upon as a key marketing opportunity.

At some point the good news is going to run its course. At this time all worries will have been set aside and everyone will be bullish. This is when tops in the market are formed. The question remains; will you be ready with hedges in place when this happens?

About the Author(s)

You May Also Like