March 7, 2016

The USDA recently released its long-term projections for agriculture. The report in its entirety can be found at usda.gov/oce/commodity/projections. Tables 1, 2, 3 and 5 are taken from this data.

I did not find anything startling in the 99 pages of data and projections, but I did find the following quote in the Macroeconomic Overview section interesting:

“Global macroeconomic conditions reflect relatively sluggish economic growth in developing countries, a strong dollar, and low oil prices in the near term, with stronger developing country growth, a somewhat weaker dollar, and rising oil prices in the longer term.”

The report does not identify what represents long-term versus short-term, but the transition from a strong dollar environment to one that is weakening may have a significantly negative impact on exports — a development we do not need, especially if we take the data at face value.

Amid global economic malaise, central banks around the world have been attempted to use monetary policy to spur their local economies through a number of policies including, but not limited to, stimulus, bond purchases and negative interest rates. Here at home, the Federal Reserve increased rates once in 2015 by 25 basis points. They have indicated an intent to increase interest rates four times in 2016. Higher interest rates make U.S. fixed income investments an attractive alternative to foreign investors, bringing capital into U.S. markets. Additional increases in interest rates would strengthen the U.S. dollar, especially against those currencies with negative local rates.

Federal Reserve Catch-22

The Federal Reserve is in a Catch-22, however. If they increase interest rates and strengthen the dollar, they risk hurting U.S. businesses that rely on exports of their goods or services. Still, the Fed’s philosophy of forward guidance has left the door open for further policy action if they believe the economy will continue to struggle. With the positive jobs report on Friday, it certainly gives the Fed cover for its first rate increase of 2016 and second increase since 2006, though many economists believe this to be relatively unlikely for the March meeting.

The last time the U.S. dollar was this strong was in August and September of 2003. That was pre-Renewable Fuels Standard policy for grains and at a time when meat exports were a smaller percentage of production.

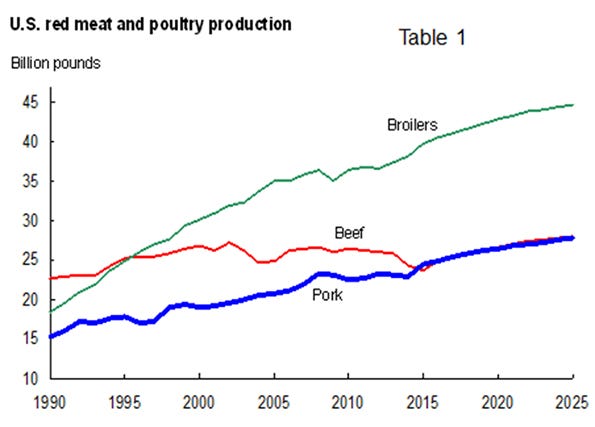

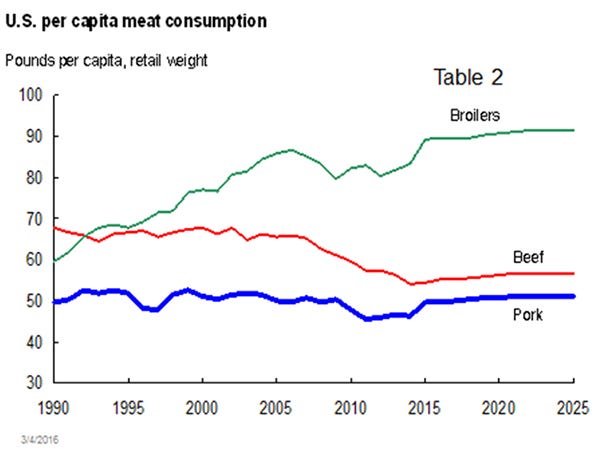

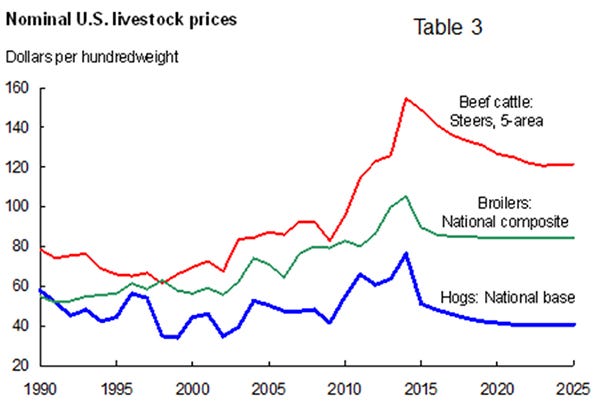

U.S. meat production is expected to exhibit moderate year-over-year increases (Table 1) while domestic consumption is anticipated to remain relatively flat (Table 2). This data implies an increasing dependence on the export market (if we produce it and do not consume it, we have to move it someplace) to maintain the balance tables relative to the production increases and pressure on prices of all meat items in the 10-year outlook (Table 3).

Weakening dollar means more competitiveness

This brings me back to the importance of the value of the U.S. dollar — a strong dollar makes our goods more expensive to importing countries whereas a weakening dollar makes us more competitive. For instance, if the dollar were to fall 20%, it will make our goods 20% cheaper for the importing entity.

As can be seen on Table 4, the U.S. dollar index began its appreciation about half way through 2014 and has remained in a relatively narrow channel since the beginning of last year. This index is measured against a basket of foreign currencies, but is not a genuine exchange rate. Rather, it is a relative index and provides a barometer of the dollar’s strength or weakness, e.g.: weakness in the Euro results in relative strength in the dollar. All other things equal, a weaker dollar would make U.S. pork much more attractive to the rest of the world if we would correct back to lower dollar values or, at minimum, maintain trade values in the recent channel.

Shining star

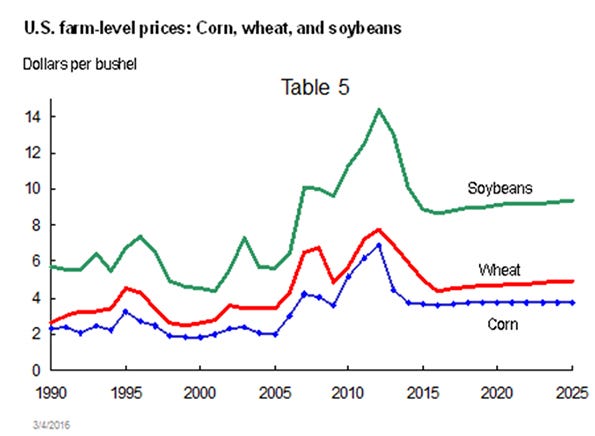

The shining star in the USDA report for pork producers is the prospect for grain prices to remain depressed for the foreseeable future, essentially maintaining today’s compressed price levels going forward. This is not great news for the grain producer, but implies tolerable costs for the protein accretion industry (Table 5). By our best guess, the 2016-17 balance sheets are not cause for panic. We have plenty of grain and soy across the world. Weather aberrations or other disruptions could, obviously, change this outlook and need to be respected.

So what is a producer to do with all of this?

Sometimes I think it is best if we take a step back and put the picture in perspective. It seems as if the whole industry is holding its collective breath in anticipation of the two new plants (Coldwater, Mich., and Sioux City, Iowa) coming online to alleviate the potential overproduction of pork that may haunt us late in 2016 . The prospects of that potential quagmire have been well articulated in this forum by the esteemed economist Steve Meyer, and we agree with his analysis.

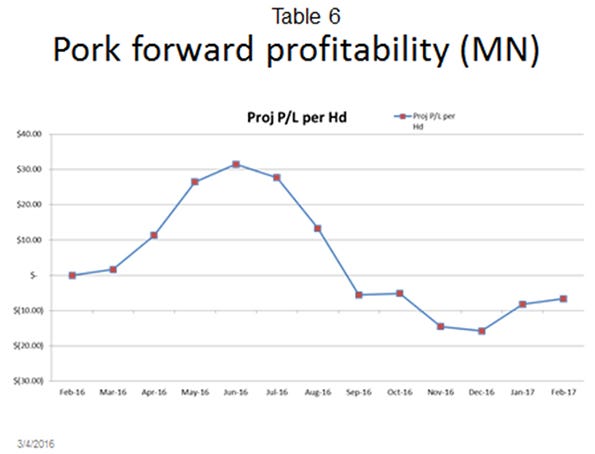

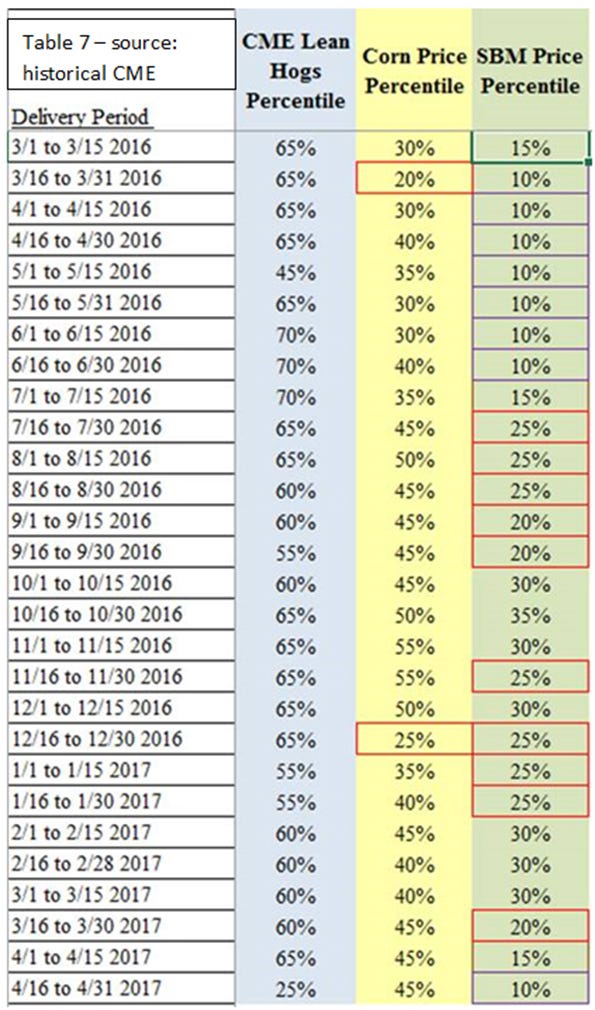

An objective look at profitability indicates two things. First, the forward profitability curve is not as bad as several forecasters (myself included) feared to start the year. Amalgamated profits from here through the end of the summer actually exceed the projected negative cash-flow we anticipate for late in the year for efficient operations such as the one depicted in Table 7. Not bad. Important note: due to the advent of ethanol we have trimmed the tails on our dataset to reflect corn at $3 representing “zero,” or the lowest sustainable market price, and soybean meal to a $200 lower threshold as well.

Inputs at attractive levels

Second, if we look at the corrected values of corn and soybean meal and lean hogs since their inception, you discover that the projected savior of pork production (low input values) are trading at some very attractive levels — at or near the cost of production. Those who were active hog market participants in 2014 know that simply placing a bet on a commodity market based on the percentile of its trading range can lead to some pretty hefty margin calls. We have to keep things in context to successfully navigate the profitability waters. With that caution in perspective, note that we generally have a favorable outlook in the revenue percentile (higher is better) and cost (lower is better) for the timeframe that concerns me the most, the fourth calendar quarter of 2016.

I encourage producers to review their operational situation and consider their risk perspective in regards to coverage values that are available from today’s markets. Our experience has taught us that one of the hardest things for producers to do is locking in small losses to avoid large losses. I believe this scenario is applicable in the later part of this year where current values do not represent profit, but may be significantly better than the values realized if we wait. The combination of relatively inexpensive corn and soybean meal (and attractive volatility — we will cover that at another time) will allow an efficient producer to post modest gains for calendar year 2016, even if each month is not characterized by profit.

Comments in this column are market commentary and are not to be construed as market advice. Trading is risky and not suitable for all individuals.

About the Author(s)

You May Also Like