The key to success with any strategy is to determine a plan that is based on a tangible goal or objective — such as protecting a minimum level of profitability — which makes sense for your operation.

Hog producers are starting off the year with much better prospects than many had expected as recently as a few months ago, and there are reasons to be optimistic that margins could rise even further. But agriculture producers know all too well that any number of variables could also turn markets quickly in the other direction. The good news is that you can use simple, flexible hedging strategies to both protect today’s attractive margin opportunities and leave open the possibility of benefitting if margins do continue to improve.

Supply strength continues

Hog finishing margins improved steadily through the fall into the winter despite increased production, as well as concerns that additional pork supplies would weigh on prices by this point in time. The USDA recently raised their pork production forecast for 2018 based on the December quarterly Hogs and Pigs report, which estimated the September-November pig crop up 3% from 2016.

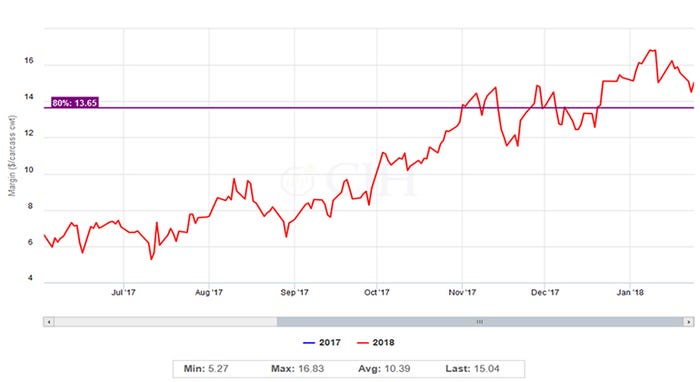

In addition, the report indicated that producers expect to expand farrowings around 3% in the first half of this year. That expansion, along with continued improvements in productivity, will support higher production into the second half of 2018 as well. While margins have backed off slightly since the middle of January, they remain historically strong — projected around the 85th percentile of the previous 10 years for the second quarter (see Figure 1).

Figure 1: 2018 Quarter 2 hog margins

Given increased hog numbers and rising pork production, much of the recent margin improvement can be attributed to demand strength, as both exports and domestic disappearance have been able to absorb the larger supply.

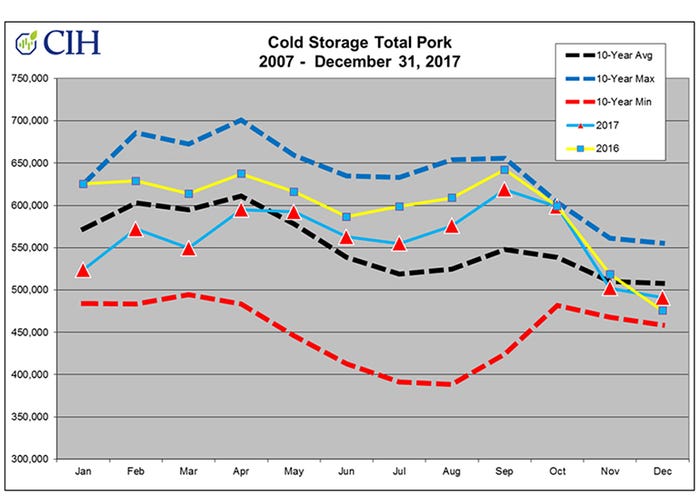

The latest USDA monthly Cold Storage report showed total pork supplies on Dec. 31 at 490.8 million pounds, down 11.5 million or 2.3% less than November. That’s compared to a 10-year average draw-down for that period of 0.45%. Moreover, the stocks figure continued a strong pace of declines since last fall, dropping from a nearly 10-year high to below average by year-end (see Figure 2).

Figure 2: Monthly pork cold storage

The stronger-than-expected margin profile for hog finishers has also been aided by a continued backdrop of historically low feed costs. Corn prices in particular have been languishing near the bottom decile of the past decade. Although soybean meal prices have moved up recently in response to weather concerns in Argentina, the increase has had only a limited impact on margins.

The opening of two new hog processing plants in Sioux City, Iowa, and Coldwater, Mich., has likewise helped support cash hog prices, with better indicative demand for pork causing processors to bid up supplies on the open market.

An optimistic outlook

Looking ahead through the remainder of the first quarter into the second quarter, there are certainly reasons to remain optimistic on the margin outlook. The U.S. dollar index has experienced a steady decline since last fall and is currently at its weakest level since December 2014 (see Figure 3).

Figure 3: U.S. dollar index (January 2014-present)

At the recent Davos World Economic Forum, U.S. Treasury Secretary Steven Mnuchin acknowledged the benefits to trade of a weaker dollar, signaling that the current administration may support further dollar weakening. We can expect increased purchasing power for buyers of U.S. pork in the global export market as a result. What’s more, the entire global economy is currently experiencing a rare, synchronized expansion that should likewise increase demand for agricultural commodity imports, particularly from developing markets.

As a reliable supplier of high-quality products, especially pork, the United States is uniquely positioned to fulfill this demand.

Risks remain

While there certainly is reason for optimism, risk factors remain that could erode profitability over the medium to longer term. As an example, the sixth round of North American Free Trade Agreement negotiations are currently under way in Montreal and hopes are high that a deal will be reached to preserve the trade pact. However, it remains to be seen if Mexican and Canadian negotiators will acquiesce to U.S. demands on their auto and dairy industries.

Some in the Canadian government have voiced concern that the United States may declare an intention to withdraw from NAFTA. Even if such a tactic is employed primarily for negotiating leverage, any move that disrupts cross-border trade between the United States and its neighbors could negatively impact the export demand structure currently in place.

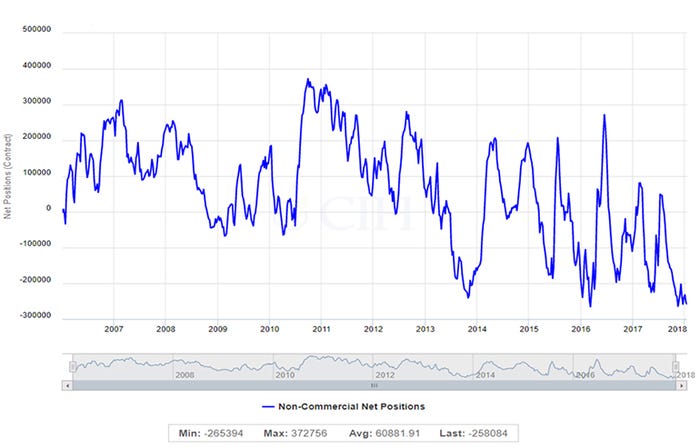

In addition, while feed costs have remained subdued, we are moving into a time of year when increased uncertainty may begin to have more impact on prices. Today’s negative crop margins could lead to significantly reduced corn plantings in the spring, and South American crops are not yet harvested. Poor spring weather could augment the impact of reduced acreage if planting falls behind. And commodity funds, which are holding a near-record short position in the market (see Figure 4), could move to cover those positions at some point as a result of one or more of these crop market factors.

Figure 4: CFTC non-commercial net corn position

Proactively manage margins

Given the strong projected profitability, hog producers may be tempted to lock-in their margins, but they would give up on any further improvement should hog prices continue to rise. They could remain open to the market so they don’t miss out on additional hog market strength, but they would carry the full risk of losses if the margin picture deteriorates. An alternative would be to establish a flexible position to address both objectives.

Strategy 1: Forward sale plus call options

One flexible strategy might entail a forward sale of hogs to the packer in combination with a purchase of call options. If hog prices rise after the sale, the value of the options would also rise. That means the producer could sell them and effectively increase his net sale price.

For instance, the operation might establish a packer sale on June hogs around the current market price of $83.50 and subsequently buy call options at a strike price of $86 for a cost of about $3. If hog prices rise to $92, the producer would still receive $83.50 from the packer, but he could sell the call options for significantly more than he paid for them. In this way, the producer will participate in all higher prices above $89, while maintaining a firm sale with the packer.

Strategy 2: Incremental futures sales

Another flexible strategy, independent of a packer, could consist of selling futures contracts on the exchange. The producer could sell a limited amount initially, then scale up to incrementally higher levels, as prices rise.

For example, they could make an initial sale on 25% of their expected production at current price levels, with a plan to initiate additional sales at two pre-determined trigger points. They may, for instance, set targets at $4 above their initial sale, and $4 above that subsequent sale, thus eventually locking into around 75% coverage on this forward production period.

Strategy 3: Put options

A third flexible strategy might be establishing a floor on production by purchasing put options. For example, again assuming a market price of $83.50, the producer might buy June puts at a strike price of $82. Similar to Strategy 1, above, these put options might cost around $3, but would provide a minimum price on the expected production while allowing the hog operation to participate in all higher prices.

However, for this strategy to be effective, the producer should establish a plan to eventually convert those put options to fixed sales at higher prices should the hog market continue to rise. Given a historical tendency for June hog futures prices to rise into the middle of March, the producer might, for example, set a target to gradually scale out of the puts in 25% increments every $2 higher, starting at $86 and ending at $92, with the intention of converting all of their puts to fixed sales by that point. Alternatively, they could establish these sales with the packer, and capture any remaining time value in the option ahead of expiration.

Don’t forget the feed side

As some of the current strong margin profile can be attributed to historically cheap corn, a producer may want to protect this risk exposure by purchasing call options on their anticipated forward feed purchases.

An example might be to buy a July $3.80 call option for a cost of around 10 to 12 cents. This would assure a maximum price of corn and protect the producer against a potential increase in price later this spring if market conditions change. Similar to Strategy 3, the producer would want to scale out of the call options as they purchase physical corn in their local cash market to salvage the residual time value of the options prior to expiration.

These are all relatively simple strategies that are flexible and help balance the dual priorities of mitigating risk exposure while retaining opportunity for margins to improve. The key to success with any strategy is to determine a plan that is based on a tangible goal or objective — such as protecting a minimum level of profitability — which makes sense for your operation. And then stick with it. While it’s human nature to try to maximize gains as margins are improving, no one knows what the markets will do, so it’s important to have the discipline to carry out your well-conceived plan.

If you have questions or would like to discuss how to implement a margin management plan for your operation, call 866-299-9333.

There is a risk of loss in futures and options trading. Past performance is not indicative of future results. Copyright 2018 Commodity & Ingredient Hedging LLC. All rights reserved.

About the Author(s)

You May Also Like