March 30, 2015

The USDA’s quarterly Hogs and Pigs report, released on Friday came in close to analysts’ pre-report expectations and Lean Hogs futures reacted as expected today with nearby contracts posting small gains and deferred contracts gaining $1.50 to $1.75.

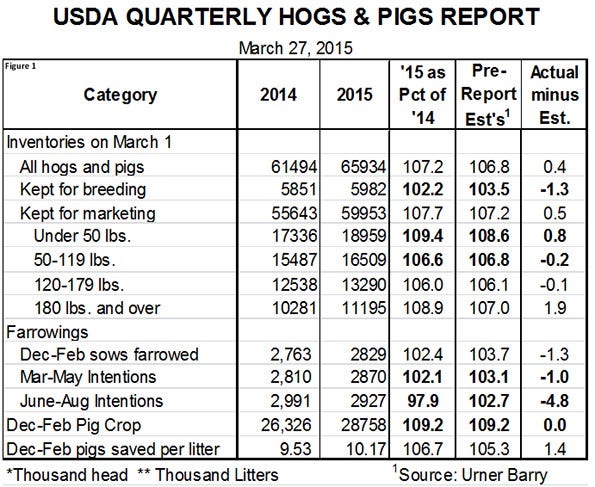

That late-year strength was based on the one surprise in the report – a sharply lower figure for June-to-August farrowing intentions. The key national data from the report appear in Figure 1. Some highlights are:

Some highlights are:

An expected sharp increase in market hog numbers. The March 1 inventory of 59.953 million head is 7.7% larger than one year ago and primarily reflects much lower pig losses to porcine epidemic diarrhea virus.

The December to February figure for pigs saved per litter, at 10.17, is 6.7% higher than last year and fits almost perfectly with the level we predicted in December if PEDV losses were near zero. This litter size returns us to the long-term trend but it remains to be seen how quickly the industry might begin the climb that was driven by 2% annual gains in litter sizes for almost a decade. All we’ve done is make up lost ground so far.

A smaller-than-expected year-over-year increase in the breeding herd. While analysts thought the breeding herd would be up 3.5% (following December’s 3.7%), we think sow slaughter since Dec. 1 never supported that kind of number. The 2.2% looks reasonable and says we have put in 43,000 sows since December. Given anecdotal evidence, that number is certainly possible.

The internal relationships of this report are solid. The pig crop and under 50-pound inventories line up as do the breeding herd and farrowings – with that one exception. Further, the 180-pound and over inventory of 11.195 million head is 8.9% higher than last year and slaughter since March 1 has been just over 8% larger. Close enough.

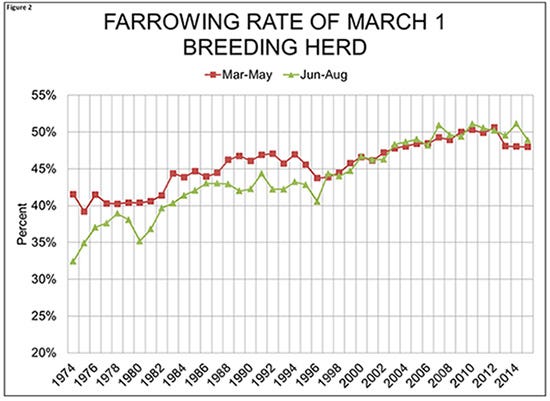

The “goofy” June-to-August farrowings figure says that a breeding herd that is 2.2% larger than last year will farrow 2.1% fewer litters. We think this figure is an artifact of last year’s June-to-August farrowings being off-the-charts high (see Figure 2). If that observation for 2014 was a more normal 49% of the March 1 breeding herd, this year’s 2.927 million litters would be 2.1% larger than one year ago and fit the other breeding herd and farrowings data very nicely.

The USDA revised the June-to-August 2014 pig crop upward by more than 3%. That basically accounts for the large slaughter runs we have seen in the past four months.

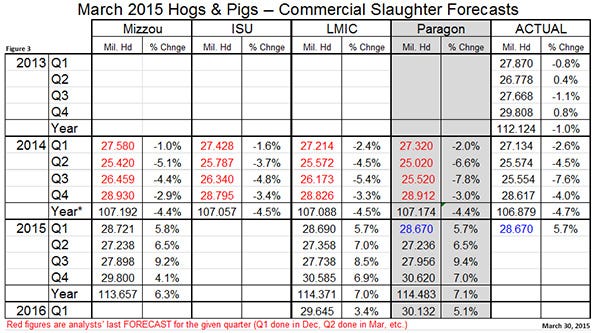

What are the implications? Obviously, we are going to have a lot more hogs on the market this year. Further, it is somewhat reassuring that the market did not react harshly to these larger-than-normal year-over-year increases. They represent a return to pre-PEDV days and imply slaughter levels slightly larger than those of 2013 through the third quarter. Weights, though they will be lower than in 2014, will still be about 3% higher than in 2013.

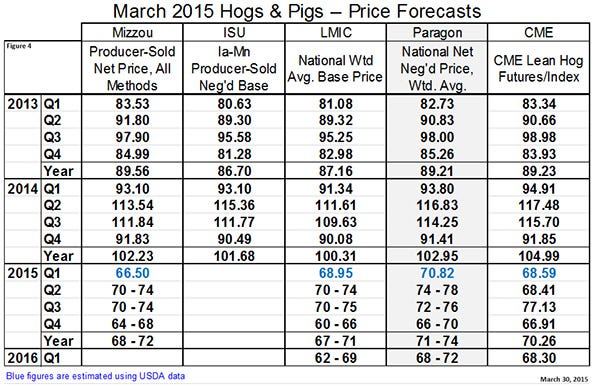

That combination would put 2015 prices below those of 2013 but not by nearly as much as Lean Hogs futures suggest at the present time. In fact, using 2013 as the base and allowing that 3% increase in weights would put early summer prices in the upper $70s and late-summer prices in the mid-$80s. We think that is possible but probably unlikely given the strength of the U.S. dollar and the low point from which this year’s expected seasonal rally will be launched. Our slaughter and price forecasts and those of Ron Plain at the University of Missouri, and Jim Robb and his staff at the Livestock Marketing Information Center appear in Figures 3 and 4.

About the Author(s)

You May Also Like