The big challenge for the pork and hog markets will be the fact that pork and hog demands are inelastic

June 15, 2015

Given the reaction of Lean Hogs futures over the past two weeks, one would think the recent surge in slaughter was completely unexpected. As of Friday, LH futures had given back about $8 of the $10 rally we had seen since late-March. I don’t think anyone anticipated that sell-off but we have to remember that few expected the rally. I was sort of alone on that one. I do hope producers took advantage of the opportunity it availed.

After Friday’s expiration of the June contract, July Lean Hogs is now the spot contract. It closed Friday at $78.05. That compares to $80.07 for the net price on negotiated hogs and $81.99 on the average for all producer-sold hogs. The all-hogs average is being pulled higher by the price of “other market formula” pigs which were determined by futures prices but, with the average at $84.20 on Friday, those futures-based deals were made some time ago when July LH futures were higher.

Closing the basis gap

So what will give to close the basis gap? My bet is always on the futures in the spot month since “cash is king” and the prices of hogs in the short run are based on producers’ and packers’ actual knowledge of the supply-demand situation, not the speculation on those matters of someone who may not even live on this continent. That person’s opinion (and money!) counts and is needed for a properly functioning futures market. Those opinions are just not nearly as important in the spot month.

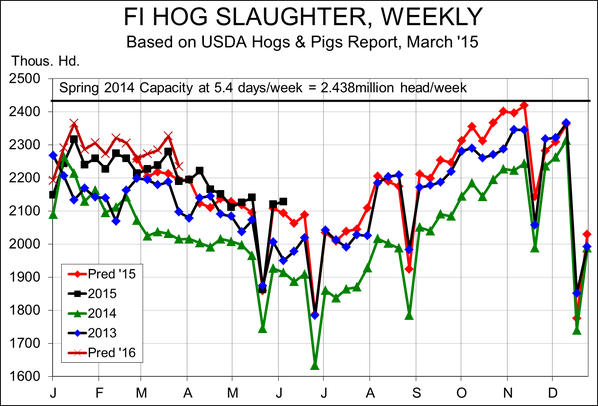

Nevertheless, this surge in slaughter should have been completely expected. Figure 1 shows our computations based on the March Hogs and Pigs report and you can see that last week’s numbers were a bit high but that our forecast reflected these numbers pretty well. The March report suggests that slaughter from here through the end of September will be 9% to 10% higher than last year.

Figure 1

Even with those large year-on-year increases, though, July should see slaughter drop back below 2.05 million head per week. Further, weights dropped back to 211.5 last week after the surge of the two prior weeks raised some fears that we were getting backed up by less-than-aggressive packer buying. Last week’s weight tied the week of May 8 for the year-to-date low, and I expect further reductions as summer temps warm up and feed intake levels suffer. The normal reduction from mid-June to the seasonal low in late-July is usually 3.5 pounds. If that happens this year, the summer low will be about 208.

Inelastic demand

The big challenge for the pork and hog markets will be the fact that pork and hog demands are inelastic – and very much so for hogs.

An inelastic demand means that variations in price will drive relatively small changes in the quantity that consumers will buy. A great example of an inelastic demand might be salt. Do you buy any less when the price surges? Any more when it falls? Probably not, so your demand for salt would be inelastic.

The situation is not as bad for pork, but most estimates of the elasticity of demand for pork are in the range of -0.5 to -0.75 meaning that a 1% increase (decrease) in the price of pork would cause consumers to purchase 0.5% to 0.75% less (more) pork. The decision variable, of course, for hogs and pork is the quantity supplied so we have to take the inverse of the demand elasticity to get the impact of supply on price: A 1% increase (decrease) in quantity supplied will result 1.33% (1%/0.75) to 2.0% (1%/0.5) lower (higher) prices. Since, in either quantity- or price-dependent case, the price change is larger than the quantity change, quantity and total revenue are negatively related.

Last year, pork producers benefited greatly from the inelastic demand for pork as quantities tightened unexpectedly. This year, that same inelasticity is not so much fun as prices and total revenue have fallen.

Can anything be done?

Improving demand (ie. moving the entire demand line in a traditional supply-demand diagram to the right) will cause prices to be higher for any given level or quantity. This is precisely the goal of the National Pork Board and direct sellers of pork when they execute promotional programs aimed at changing consumer attitudes, tastes and preferences.

However, real per capita expenditures for pork (a measure of the level of demand) has improved by 5.5% and 7.6%. Those are the first and third largest annual gains in our database that goes back to 1988 and the one in between them happened in 1998 when then-record output pushed consumption higher and retail prices, to the chagrin of many, hardly budged downward. These two straight years of gains of this magnitude do not preclude continued improvement but they certainly make it a bigger challenge, especially with lower chicken prices on the horizon.

The other action is to be careful about quantity increases. That, of course, falls squarely on producers who every day are deciding how many sows to breed for future production. No one producer determines the magnitude of any change but everyone contributes to it – a fact that all should remember as they approach planning for 2016 and beyond.

About the Author(s)

You May Also Like