How does China pork production stack up to U.S.?

January 12, 2017

China produces roughly half of the world’s pork, but as more of its citizens trade the rural lifestyles for city living the traditional small-scale “backyard” pork production is not filling the growing demand for pork. As a result, China has also become the leading importer of pork. Many factors prevent Chinese pork prices from declining, making imported pork and other animal proteins more attractive to consumers, processors and foodservice buyers in China.

In the USDA Economic Research Service recently released report, China’s Pork Imports Rise Along with Production Costs, USDA economist Fred Gale reveals the price-competitiveness of imported pork in China by comparing hog production costs and productivity for U.S. and China farms.

For the purpose of this report, the input costs and hog prices were based on a survey conducted by China’s planning commission (CNDRC, 2015) The CNDRC costs were converted to U.S. dollars at the official exchange rate to compare with U.S. hog production costs during 2000-15.

Rising Chinese production costs

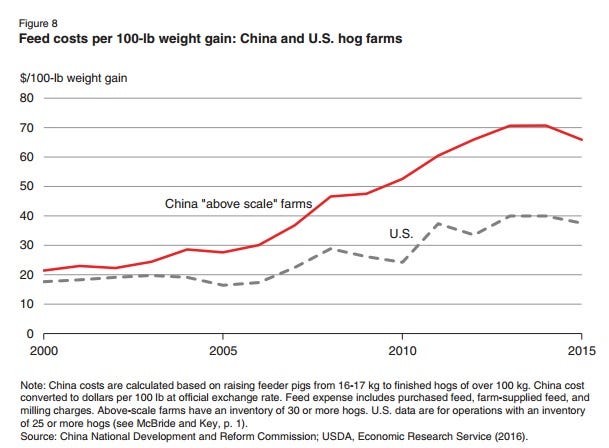

Feed costs remain the highest input cost for both U.S. and China hog farmers. However, the cost of feed per pound of hog live weight equaled about 35 to 40% of the retail pork price from 2009 to 2015 according to CNDRC data. Similar to feed costs in the states, the average price of feed in China climbed steadily from 2000-14 and dropped in 2015. Feed costs for China’s hog farms more than doubled from $21 to $70 per 100 pounds during 2006-14, Gale calculates. U.S. costs rose at a slower pace, increasing from about $17 to $40 per 100 pounds during 2006-14. This study found that feed costs for China’s hog producers were about 20% higher than those incurred by U.S. producers during 2000, but the difference grew to 77% in 2014. At the end of the period, Chinese feed costs were still 75% higher than U.S. feed costs that year.

Despite low wages in China, labor costs per unit of output for China’s hog farms are now much higher than in the United States because labor productivity is also very low, notes Gale. As shown in the figure below, U.S. labor costs fell slightly to $2-3 per 100 pounds during 2004-15—reflecting growth in labor productivity — but China’s labor cost soared to $16 per 100 pounds in 2014-15.

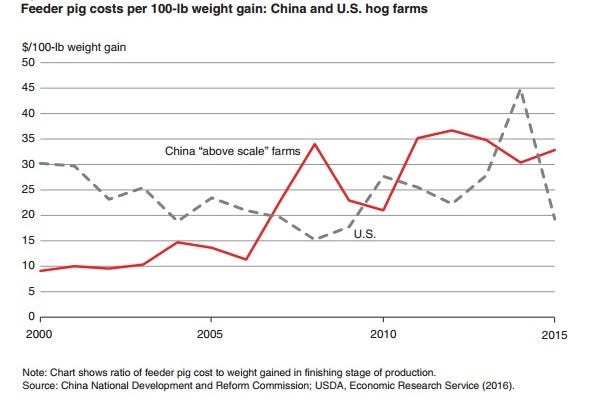

Fluctuation in feeder pig cost over the 15 years is a common thread across any pork-producing country. While disease outbreaks fueled the volatility in feeder pig prices higher at different times for both the United States and China, neither country has had a clear cost advantage as feeder pig costs.

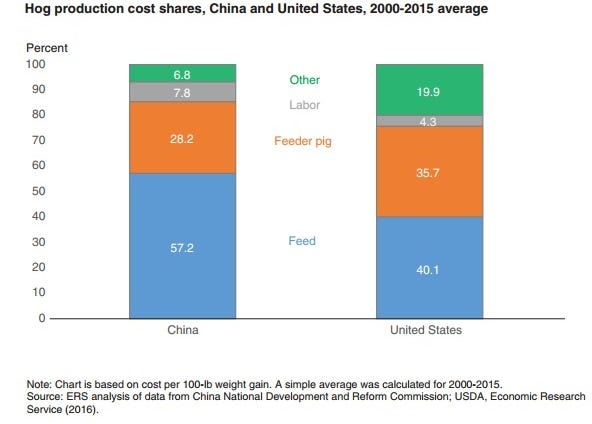

Looking at hog production’s bigger picture, the share of each input costs contribution to production costs is illustrated in the table below

U.S. excels in efficiency

In line with historical data, America’s pig farmers outshine the Chinese hog producers in total production efficiency. Nevertheless, the China government has established a five-year plan specifically, targets improvements in feed conversion and labor productivity.

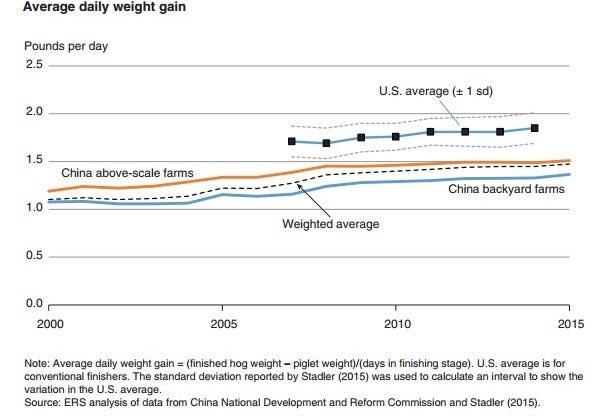

For now, in China, the average daily weight gain rose from 1.2 pounds per day to 1.37 pounds per day during 2000-15, but remained lower than the U.S. average of 1.85 pounds per day in 2014. The faster weight gain in recent years reflects a shift toward “lean-type” swine breeds in China. The 2014 U.S. weight gain was 24% faster than large-scale Chinese hog operations and 39% faster than that of backyard farms.

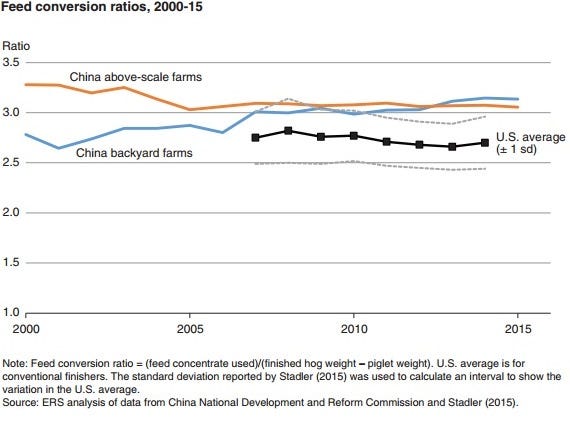

The Feed Conversion Ratio, the pounds of feed concentrates consumed per pound of weight gained in the finishing stage, indicate U.S. producers are more efficient at converting feed to weight gain than are Chinese producers. “The 11% to 15% U.S.-China difference in FCR is much less than the 24% to 39% U.S.-China difference in daily weight gain, suggesting that the faster U.S. weight gain is achieved partly by using larger amounts of feed than Chinese farms use,” explains Gale.

As more backyard operations are being abandoned and larger, more modern barns are being built and incorporating newer genetic lines, the Chinese could make significant gains on the U.S. pork industry. Also a government five-year plan specifically targeting improvements in feed conversion and labor productivity could narrow the efficiency difference between China and other competing countries like the United States.

In conclusion, Gale states “China’s emergence as a pork importer reflects growing resource scarcity as the nature of hog production there undergoes dramatic change.”

You May Also Like