The U.S. pork industry is venturing into unfamiliar territory. A magnitude of change will define its future.

June 30, 2017

The U.S. swine business is in a seismic shift as the magnitude of change over the next several years will define its future. “The next five to 10 years will be the biggest dynamic changes in the pork industry,” says Mark Greenwood, AgStar Financial Services senior vice president.

Speaking at Iowa Swine Day, Greenwood confirms the industry’s financial strength has led to capital spending or reinvestment into production. “It is really a combo platter between production and packing plants,” he notes.

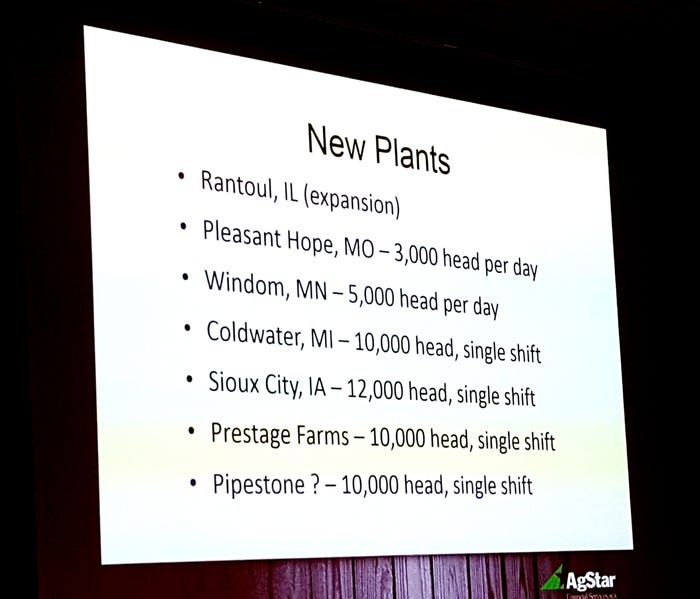

Healthy packer margins over several years stimulate growth in pork processing capacity as five new plants are set to be operational by 2018. Meanwhile, processors will add shifts or expand current facilities to handle the additional market hogs so long as they are making money.

For the most part, U.S. hog farmers are also showing solid balance sheets despite the narrow margins last year and the rough start to 2017. Input costs remain affordable as feed prices are at a lower level. Also, many producers, learning from previous tough financial years, paid down operation and real estate debt. The financial strength of the industry is real. Greenwood says the majority of hog farmers can lose $20 per head for two straight years without touching their operating money except to pay taxes.

Financial strength gives hog farmers the sureness to expand. “When you have a strong balance sheet, you tell your lender what you are going to do,” explains Greenwood.

However, he warns not to get overconfident. He encourages U.S. pork producers to strive for continuous improvement in productivity and financial strength. Despite the record amount of pork being produced, prices are better than anticipated on Jan. 1, 2017. Still, Greenwood asks, “As we increase pork supplies this fall, can we keep our value?”

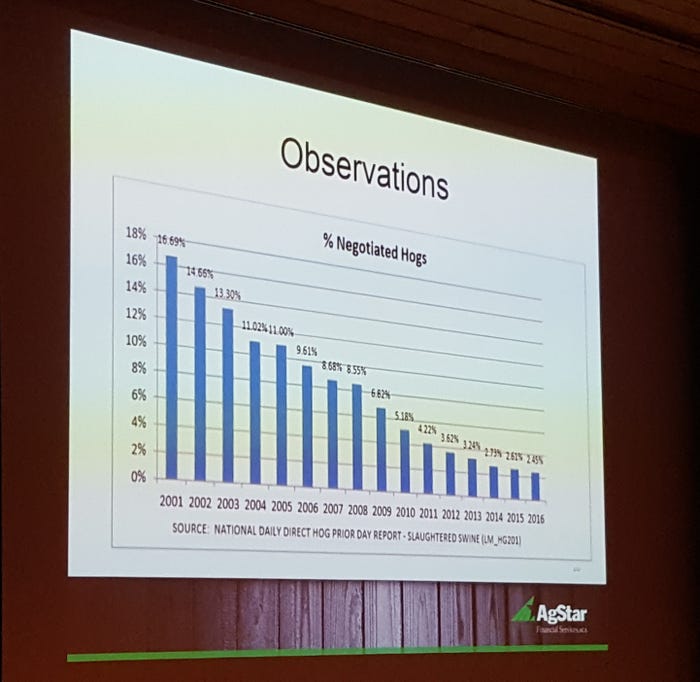

One area all pig farmers and lenders can work on is negotiating more hogs on the open market. It needs to be a more coordinated effort. Currently, only 2.5% of hogs are negotiated. Greenwood recommends 5-10% is a more comfortable level for the industry. He understands it takes more work for producers. However, Greenwood further explains producers selling on the open market have a better handle on the future markets. “Yes, it does take work, but the best of the best are doing it,” stresses Greenwood.

Words of wisdom

The U.S. pork industry is venturing into unfamiliar territory. Robust export markets and product innovation are driving demand. Pork bellies featured on menus from fast food to fine dining is good news for the swine business.

Consumers’ preference and shopping habits are also evolving. Busy family schedules are embracing online shopping and pre-packaged meals. It will require an adjustment for the entire industry and a coordinated effort for marketing pork and telling the real pig farming story.

Only time will tell if hog prices sustain as production rises. Any disruption to the export market can be a game changer.

Be that as it may, looking ahead Greenwood foresees more integration. Pork processing must take a broader approach and capture a true value through brands. More alignment between producer and processor is anticipated, but the industry needs to find a balance with some pigs negotiated in open market space.

Overall, Greenwood advises all hog farmers to think long term, utilize data to drive decisions and continue investing in new technology and employees’ talent. He stresses, “The single biggest risk to this industry is people.”

Successful pork producers share similar qualities. Greenwood suggests the following tactics for fruitful pig farming.

• Be great at blocking and tackling. Without that, you have no shot.

• Embrace data management and use the information to make sound decisions that add to your financial bottom line.

• Benchmark against your peers to better understand where you stack up.

• Be willing to change the current practices for overall improvement. Avoid the status quo.

All pig farmers need to look at the whole picture. Don’t become too isolated. Understanding the entire fundamentals of the global pork industry will keep hog farmers in the swine business long term.

You May Also Like