Crop report pleasant surprise for livestock producers

Our long-term interpretation is good for animal agriculture; our short-term focus should be in acquiring physical corn now.

November 13, 2017

The November crop report was a huge surprise for the trade and is good news for animal agriculture — even as it is not-so-good news for the crop production sector.

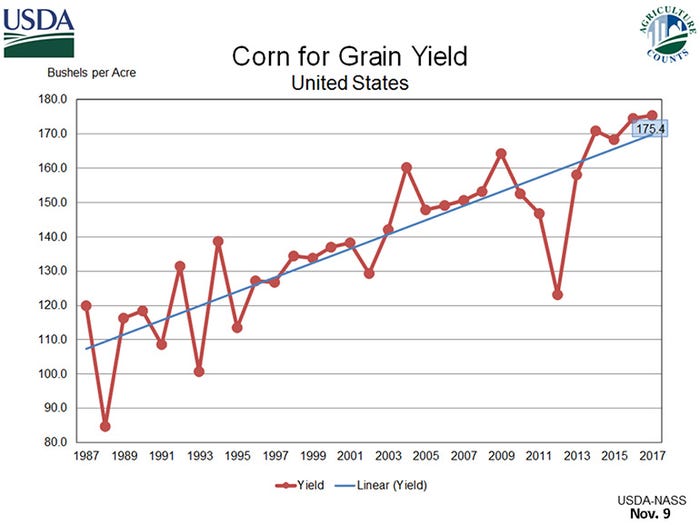

The USDA published a corn yield number over 175 bushels per acre, setting a record for the U.S. crop. How can this be that this year’s yield is better than last year’s? For those of us who live in the Midwest, this is a phenomenal development. Statistically, many areas of the main corn growing regions experienced a one standard deviation below normal rainfall. Iowa and Illinois, both, increased yield 6 bushels per acre from the October to the November numbers. What does this mean to us and to subsequent crops?

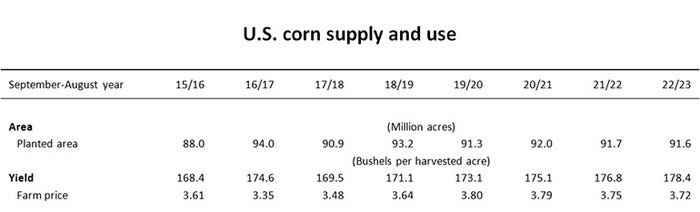

In my opinion, this is a very important development for both the United States as well as the world. One of our main fears on an annual basis is, “what happens if we have a drought?” Well, we just answered that question and it resulted in record yields. This cannot be ignored. The Food and Agricultural Policy Research Institute numbers that were released last month indicate five years of corn trading at roughly $3.75 (see table below). We have ample reason to believe this projection as both the U.S. balance sheet and the world supply-demand projections indicate production of more corn than the world wants to utilize at price levels that are profitable to the grain farmer.

Our long-term interpretation is good for animal agriculture; our short-term focus should be in acquiring physical corn now. Remember, the month of November sets the baseline price for insurance purposes. We are essentially providing the farmer a free put option right now. If the price moves lower, he collects insurance. Thus, as there is little incentive for the corn farmer to sell anything more than what he has to at these levels, it is incumbent on us to own basis here and now. We have not felt the pinch too much yet, but remember that the ethanol industry generally runs on skinny inventories and will be needing to buy corn by the end of the month. I believe we could see a narrowing basis response. Own cash corn if you can.

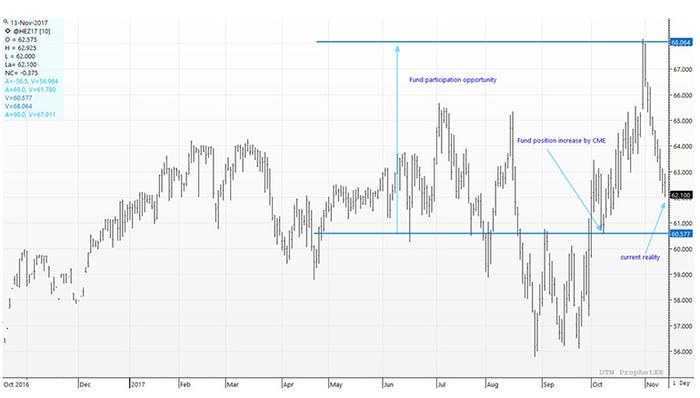

If you were perplexed regarding December hog’s recent run to over $68 prior to their recent setback, you have ample company. The collective “we” has a tendency to focus on the supply side of the equation because it is much easier to count and calculate. It is in our blood to pay attention to sow inventories and shifts in pigs per sow per year, it is much more difficult to ascertain shifts in demand as they are occurring; we only look in the rear-view mirror for much of this data.

Something that falls between the tangible (sow numbers and productivity) and the ephemeral (demand) is the influence of the fund community and their money-flow impact to the market. In mid-October, the CME allowed fund positions to increase 33% in size (4,500 contracts to 6,000) and the subsequent impact to the market has been obvious. Look at the chart below depicting the trading area of the December contract prior to the increase in fund position size and the movement of the market when they stretched their legs with additional long positions in our market. Impressive.

Bottom Line: if you are not yet doing so, you are going to have to pay more attention to fund influence as we roll forward — long or short. Keeping some dry powder to reward the market when the funds want to expand their ownership will be just as important as maintaining coverage when they want to be big sellers.

As of this writing, there is little talk from the current administration regarding the fate of the North American Free Trade Agreement or other trade agreements that our industry depends upon for product disappearance. My Twitter feed is indicating a 7th grade name calling contest between our president and the North Korean ruler regarding who is old and who is fat. You can’t make this stuff up. It seems to me that the fate of agricultural trade is less important than the war of words between two entities that have access to nuclear weapons.

China has announced the liberalization of their distiller’s dried grains with solubles ban at the same time when there is a heightened concern for inspection certificates of soybean shipments to that country. The bottom line is that our confidence level of stability is hampered with this backdrop. 2018 is offering good profits — roughly $20 per head — to pork producers given the compression in grain markets combined with trade levels on the CME for lean hogs. I am an advocate of protecting profits at these levels for the coming year.

Comments in this column are market commentary and are not to be construed as market advice. Trading is risky and not suitable for all individuals

About the Author(s)

You May Also Like