January 25, 2016

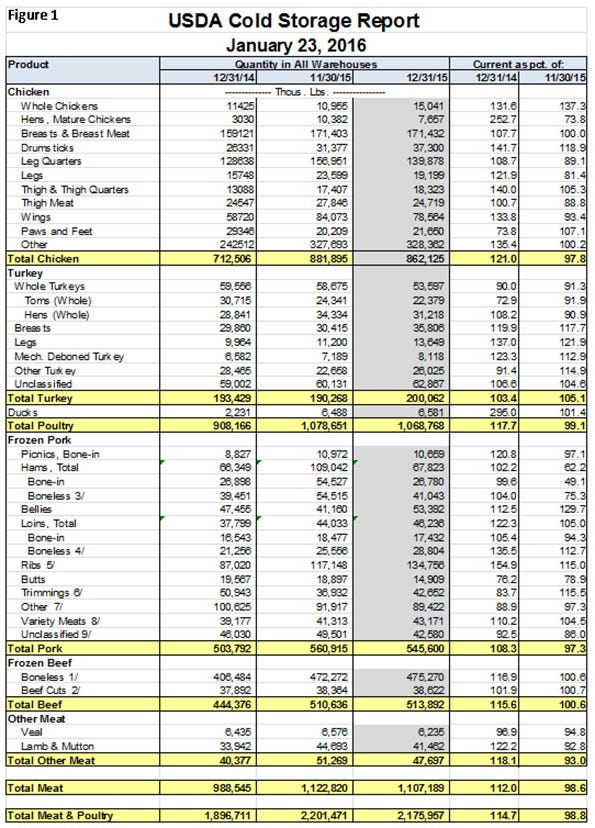

Friday’s Cold Storage report was, we think, friendly to hogs and pork, neutral for cattle and beef and slightly positive for chicken. The report, whose key numbers appear in Figure 1, showed that total meat and poultry inventories remain large at 2.176 million pounds (14.7% larger than one year ago) but that they did decline by 1.2% in December.

Pork inventories are still large but the December change was much larger (-15.3 million pounds) than normal (+1.8 million pounds) even as we set a record for pork production per slaughter day. December pork production of 2.207 billion pounds carcass weight was the second highest ever; second only to October 2012 when 2.211 billion pounds were produced. But December 2016 had only 22 slaughter days while October 2012 had 23.

Produced a lot of pork; used a lot more

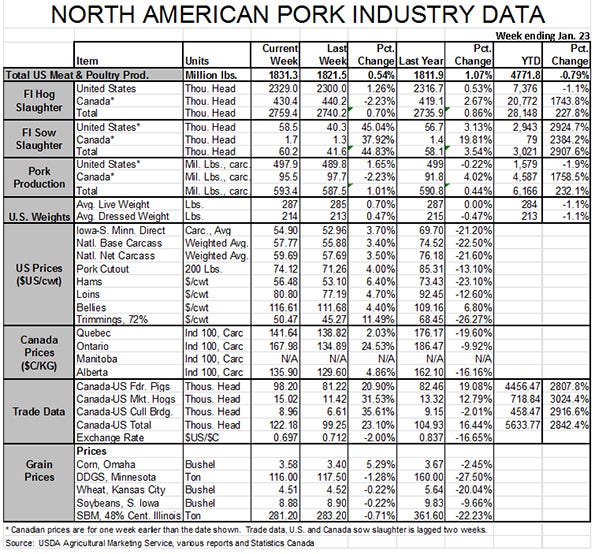

But I digress. The important lesson is that we produced a lot of pork and used even more during December. We still don’t know exactly where all that pork went but recall that November exports were 19% higher than one year ago. They still weren’t robust by any means, but they did take more product off the U.S. market than they did one year ago.

Given lower wholesale prices, that likely continued in December but I seriously doubt that any export growth accounted for both the added production and the drawdown in stocks. Lower retail pork prices (only 1.9% versus last year and 1.4% versus last month) helped move some more volume but we think the modest price declines will, when compared with domestic disappearance, mean that pork demand was relatively strong in December. We will not know that until December export data are released.

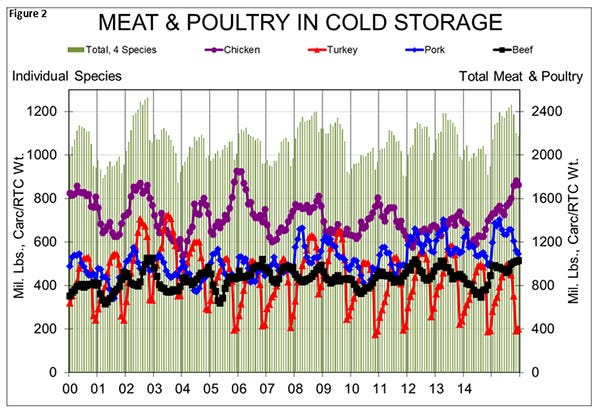

Chicken inventories were lower for the month, but remain very burdensome and 21% larger than last year. As can be seen in Figure 2, these chicken stocks are still very close to all-time highs and we have to remember than the fourth quarter is the seasonal low for chicken output. Where leg products have led these increases most months this year, they were no more a contributor in December (+19%) than were other chicken items. Beef stocks remain very close to record large.

Ham inventories declined 37.8% during December, and are now just 2% larger than they were one year ago. The December drawdown of ham stocks was about 10 million pounds (25%) larger than normal. The Dec. 31 stock of 67.823 million pounds was by far the smallest so far this year. Back on April 1, U.S. ham inventories were 66.6% larger than one year ago.

Belly stocks of 53.4 million pounds were 12.5% larger than one year ago. Here again, the December change (+12.23 million pounds) was significantly smaller than the five-year average change of +16.736 million pounds.

Feeders, fats reflect bearishness

Friday’s Cattle on Feed report was somewhat bearish for cattle futures and both feeders and fats reflected that in Monday’s trading. Placements were the most bearish aspect of the report, coming in over 4% higher than was expected, on average, by analysts who were surveyed beforehand. Lower feeder cattle imports, recent cattle market volatility and some pretty harsh weather were all very good reasons for sharply lower placements (analysts thought about 5%). But those don’t seem to have mattered much as feeders placed 1.525 million head, just 0.8% fewer than one year ago.

The cattle and beef markets are still dealing with an extremely front-loaded supply of cattle, however, with still 11% more cattle in inventory that have been on feed 120 days or more. That’s a smaller number than at many time in the past nine months but still a bunch of long-fed cattle that, in spite of some rough weather and some efforts to get current, are still very large! We still think the beef sector will be under some pressure through the first quarter, but I still expect live prices back in the mid-$130s by April.

Be ready to price those hogs

I will include another urging for pork producers to be pricing or ready to price hogs. My contention that we would see some $80 hogs this summer doesn’t look quite so silly (thank goodness!) now with June and July futures closing above $79 today. The average for today’s close across the eight contracts was $72.06. With average costs in the mid-$60s, those prices mean profits, on average, north of $10 per head this year.

Fourth quarter futures are now $67.60 and $63.40, a darn site higher than my $59-$61 forecast for national net negotiated prices in that quarter. The market is still trending upward so keeping some or all of your powder dry is advisable. But you may be near “seeing the whites of their eyes” as Old Hickory told his waiting soldiers. The time to fire is drawing near, I think.

About the Author(s)

You May Also Like