Hogs & Pigs report neutral to hog market while China’s tariff announcement pressures hog prices.

April 2, 2018

If ever there has been a neutral Hogs and Pigs report, Friday’s was it. I don’t recall a report in my professional career in which the actual numbers were this close to the average of analysts’ pre-report estimates. This report is about as neutral to U.S. hog and pork prices as it can be.

The pressure on futures prices today is, in our opinion, completely attributable to China’s announced yesterday that U.S. pork and pork products would be hit with a 25% tariff in the escalating trade battle between the United States and China. There was nothing in the Hogs and Pigs report that would justify a limit or near-limit down move in lean hogs.

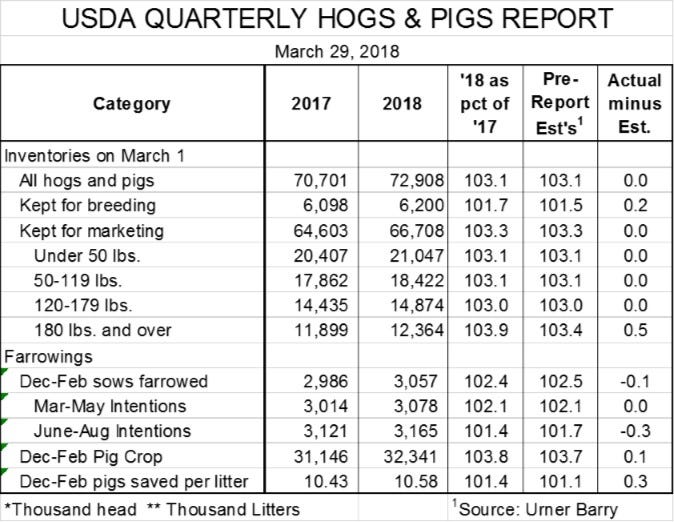

Figure 1 shows the report’s key national supply data as well as the average pre-report estimates of analysts as compiled by Urner Barry. Note that the percentage of one year ago figures for the actual inventories of hogs and pigs differed from the average pre-report estimates in only two instances: The breeding herd and the 180-pound and over category. All of the others were, to one decimal point, equal, suggesting that this information was likely already incorporated into futures prices. That is not a certainty of course as actual traders — and especially commodities funds managers — may have expectations that differ from the average of the surveyed analysts. But these are about the best we can do to determine the market’s view of the report before it is released. And the two items of difference are not critical to the immediate market outlook.

Figure 1

The 180-pound and over numbers is more historical than predictive as most of those hogs have already been harvested. Comparing an equal number of weekdays and Saturdays this year to last year, FI slaughter has been 4% larger, year-over-year, since March 1. That almost precisely fits USDA’s 3.9% year-over-year growth of heavyweight hog inventories, adding some instant validity to the report.

The breeding herd, of course, gives us a long-term picture of the change in the “production plant” of the U.S. pork industry. Everyone knows that that plant has been growing steadily in recent years. USDA’s December 2017 revisions to its breeding herd estimates from December 2016 through September 2017 increased the trend growth of the herd to 1.2% per year. This report says that the pace had increased again but the 1.7% year-on-year increase should be no shock to producers or other industry participants given the ample anecdotal evidence of growth the past 12 months. In fact, anecdotal evidence would suggest that this pace might still be slower than the actual growth of the breeding herd.

USDA’s farrowings and farrowing intentions number continue the new relationship between farrowings and the breeding herd that we saw in the December report. Pigs saved per litter set another quarterly record in the December-to-February quarter. Bottom line: U.S. producers continue to become more efficient. Want a shock? Consider the number of sows we need to harvest 125 million head if every herd gets to 30 pigs per sow per year. The answer: Roughly two-thirds of the sows we had on March 1.

So what does this mean for hog supplies in the next year?

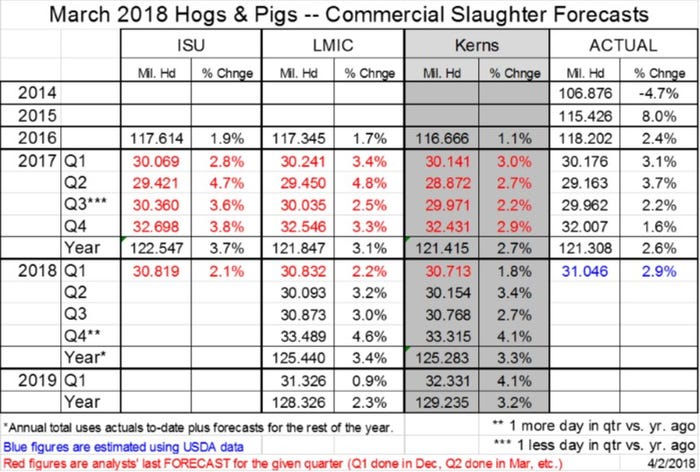

More of the same. This report does not change our forecasts from the December report significantly. The numbers and percentage changes in Figure 2 are slightly lower primarily due to a revision in our forecasts of imports of Canadian market hogs. We had expected those to grow sharply with the opening of the Clemens Food Group plant in Michigan and they have not. Imports of Canadian weaner/feeder pigs have also lagged our forecasts, so both have been reduced, pushing U.S. slaughter numbers slightly lower.

Figure 2

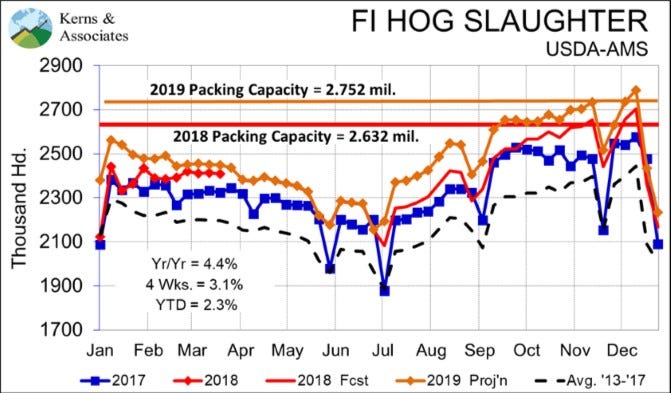

But even lower forecasts are still large, and Q4 supplies will fill even our expanded slaughter capacity. Note that the one extra slaughter day this year adds about 0.6% to the Q4 year-on-year change, but even 3.5% is a very large yearly increase. Figure 3 shows our quarterly forecasts prorated across weeks according to historical relationships. The capacity situation will, in our opinion, be tight but not burdensome this fall. Some weeks will see packers not aggressive in buying, but we think that neither the size of Saturday harvests or the duration of Saturday operations during the quarter will, in and of themselves, put negative pressure on hog prices as they did in the fall of 2016.

Figure 3

Note that our fall 2018 capacity of 2.632 million head per week on a 5.4-day work week includes only the first shift at Triumph-Seaboard in Sioux City. The company intends to begin second shift operations this summer, and I’m sure hopes to ramp up throughput aggressively. We remain concerned about the labor quantity and quality issues they will face, especially as Prestage Foods begins hiring workers for its plant.

As for prices, this report changes little in our mind. The China situation does, however, and we are going to have to take some time to compute its impact. Summer hogs in the mid- to upper-$70s are still in the cards and fall, and winter hogs in the low-$60s look reasonable. But the trade situation is troublesome, to say the least. It will likely take some positive developments there to get hog prices higher — even with a neutral report.

About the Author(s)

You May Also Like