Chilled U.S. pork makes headway in fiercely competitive Japanese market

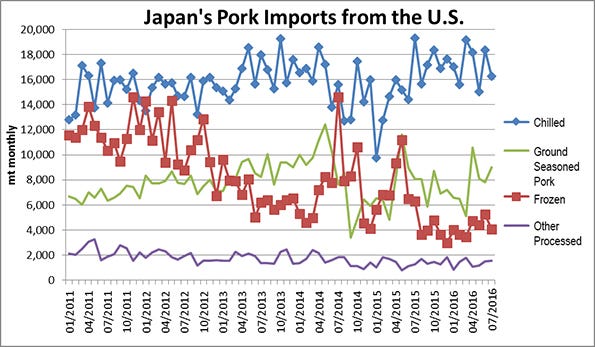

The bright spot for U.S. pork exports to Japan in 2016 is that shipments of higher-value chilled (never frozen) cuts are on a record-setting pace. Through July, exports of chilled U.S. pork to Japan totaled 126,394 metric tons, up 12% from the same period last year.

September 18, 2016

The bright spot for U.S. pork exports to Japan in 2016 is that shipments of higher-value chilled (never frozen) cuts are on a record-setting pace. Through July, exports of chilled U.S. pork to Japan totaled 126,394 metric tons, up 12% from the same period last year.

“Chilled exports to Japan were hurt significantly by West Coast port congestion in late 2014 and early 2015,” explains U.S. Meat Export Federation Economist Erin Borror. “But demand for chilled U.S. pork has not only fully rebounded from that setback, it’s now reaching new heights.”

The port congestion was the result of a prolonged labor contract impasse. With chilled pork having a shelf life of about 45 days, delayed departure from U.S. ports made it difficult for U.S. exporters to meet Japanese buyers’ expectations for consistent, timely deliveries, opening the door for competitors. Canada is the other major exporter of chilled pork to Japan, but European suppliers also capitalized on the situation by marketing thawed pork cuts to retail and foodservice buyers. This coincided with a surge in the European Union’s pork production and closure of the Russian market, previously the EU’s largest export destination, due to a dispute over African swine fever.

USMEF-Japan Director Takemichi Yamashoji says the U.S. industry has countered the infusion of European pork by targeting Japan’s regional supermarket chains with a wider range of chilled pork cuts.

“While USMEF remains active with Japan’s large national retailers, we found that the mid-sized regional supermarket chains are also outstanding outlets for U.S. chilled pork,” Yamashoji notes. “In these venues we are able to showcase and differentiate thick cuts of U.S. pork and educate consumers on how to prepare them. Japan has traditionally been a market for thinner-sliced meats, but our promotional campaigns highlighting new recipes and cooking methods are helping thick-cut pork gain popularity.”

Chilled U.S. pork cuts are merchandised in Japanese supermarkets on consumer-friendly recipe trays.

Yamashoji explains that the USMEF’s in-store promotions take a consumer-friendly approach, offering the customer an enjoyable eating experience that is also fun and easy to prepare. Supermarket customers are especially fond of the recipes printed directly on U.S. pork packaging trays.

While chilled U.S. pork’s market presence grows, EU frozen share surges

Loins, CT butts and bellies are the most popular chilled U.S. items in Japan, and Yamashoji notes the growth of these items has also been bolstered by an increase in Japan’s domestic pork prices. The ability to ship chilled product to Japan remains an important advantage for the U.S. industry as European suppliers continue to aggressively pursue Japan’s frozen pork market. Spain has been the fastest-growing supplier, with exports increasing four-fold over the past five years, including growth through retail sales of defrosted product sometimes sold next to chilled U.S. pork. Through July, EU exports to Japan were 198,784 mt, up 13% year-over-year and up 40% compared to the same period in 2013 – the last year EU pork had access to Russia. The EU’s share of Japan’s frozen imported pork muscle cut market now stands at 63%. Although the United States still supplies most of Japan’s imports of ground seasoned pork, an item commonly used by Japanese processors, imports from the EU have doubled from a year ago to 6,781 mt.

Europe’s growing presence in Japan is definitely reflected in the overall results for U.S. pork exports in 2016. Through July, total U.S. export volume to Japan was down 12% year-over-year to 223,341 mt, while value fell 10% to $879.5 million.

In terms of the costs associated with Japan’s gate price system, U.S. pork and EU pork currently face the same requirements. But this will change upon implementation of the Trans-Pacific Partnership agreement, which includes improved terms of access for U.S. pork entering Japan. However, it is also important to note that Japan and the EU could conclude negotiations on an economic partnership agreement later this year or in early 2017.

“This really underscores the importance of TPP and the benefits it holds for the U.S. pork industry in Japan,” Borror says. “TPP is not just a long-awaited opportunity for U.S. pork to gain additional access through the reduction of duties. TPP approval is absolutely essential if U.S. pork is going to remain on a level playing field with its chief competitor in our No. 1 value market.”

Data sources: USDA, Global Trade Atlas and Japan’s Ministry of Finance

You May Also Like