November 25, 2013

First, please accept the best wishes of the Meyer family and all of us here at Weekly Preview for a happy and safe Thanksgiving holiday to you and yours. There are so many things for which to be thankful. It’s a shame that we don’t stop to “count our blessings” more often, but let’s make sure to at least do so this week. High on my list is my long-standing relationship with National Hog Farmer. I’ve read this magazine since I was a teenager trying to learn about the animals I had chosen as my primary FFA project. I never dreamed I would one day contribute to the education and information mission of this great magazine. It has been an honor and an even greater honor that you would devote a few precious minutes to this column each week. Thank you.

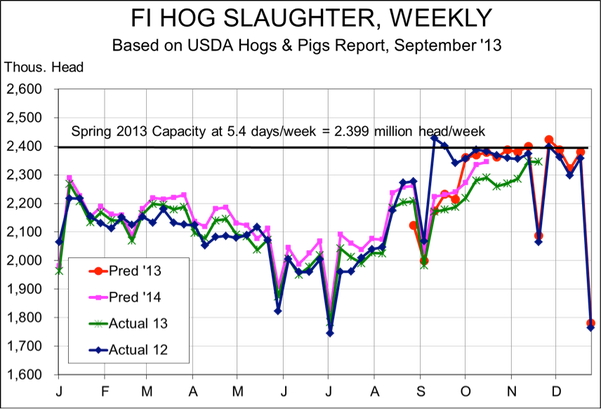

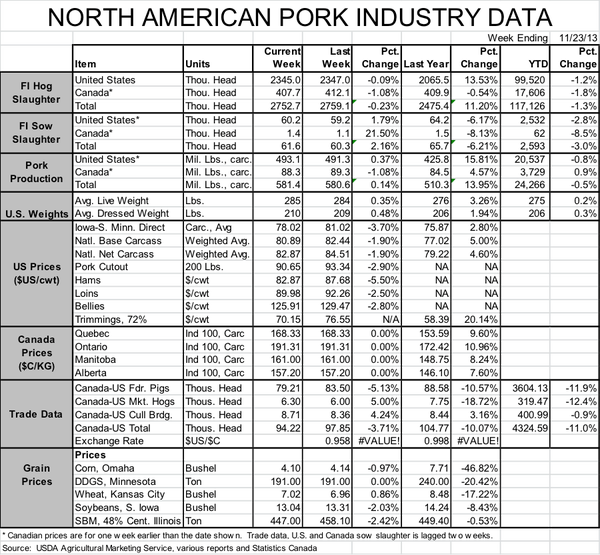

As can be seen in Figure 1, it is pretty difficult to judge whether last week’s federally inspected slaughter total of 2.345 million head was a break from this fall’s “shortage” pattern or not, since it aligns with Thanksgiving week one year ago. We’ll have to wait for this week’s total and then compare the past two weeks to the same period last year before we know for certain. But my guess is that we are going to remain 50,000 to 70,000 head below the level I expected coming out of the report.

We have gotten a bit closer to those expected levels in recent weeks, and last week’s 0.45 pound reduction in the average weight of producer-sold barrows and gilts suggests that producers are getting a bit more current in their marketings now that cash prices have fallen. But “a bit more current” and “current” are two different things. Further, a normal level of currency is probably not in the cards this year. A coming “hole” in hog availability is driving Seaboard, Smithfield and other partially-integrated operations to make up for pig losses with higher weights that have pushed the average weight packer-owned hogs to 217 lb. the past two weeks. The non-integrated companies aren’t in that pickle yet. But it doesn’t look to me like anyone will be able to completely dodge the porcine epidemic diarrhea (PED) virus supply bullet.

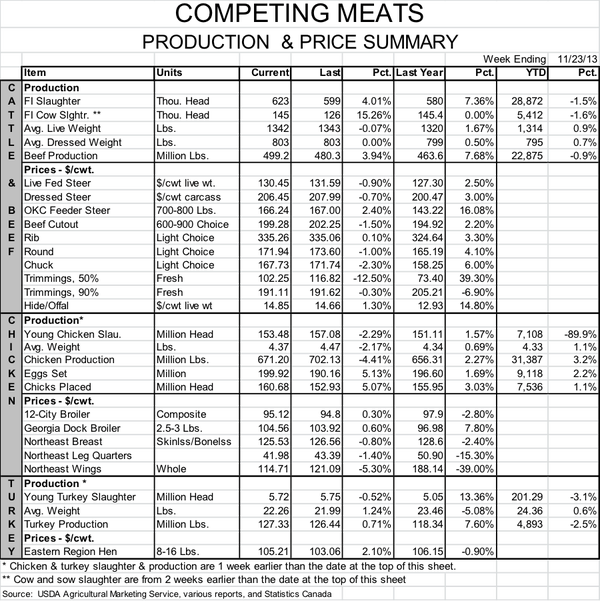

Cattle Report Helps Pork

November’s Cattle On Feed report came in just about as expected and indicated significantly higher cattle placements than one year ago. Of course, October 2012 placements were the lowest for that month in years so it is little surprise that this year’s placements were higher. But feedlot inventories are still lagging year-ago levels by 5.7% indicating that fed cattle supplies will lag year-earlier levels well into 2014. And there simply are not very many feeder cattle available with heifer retention picking up. Our thoughts are that per capita beef supplies will decline 4-6%, year-on-year, in 2014, keeping beef prices VERY high and giving pork a real, though perhaps diminished by PED virus, opportunity to change some buying habits.

Frozen Meats Positive for Pork

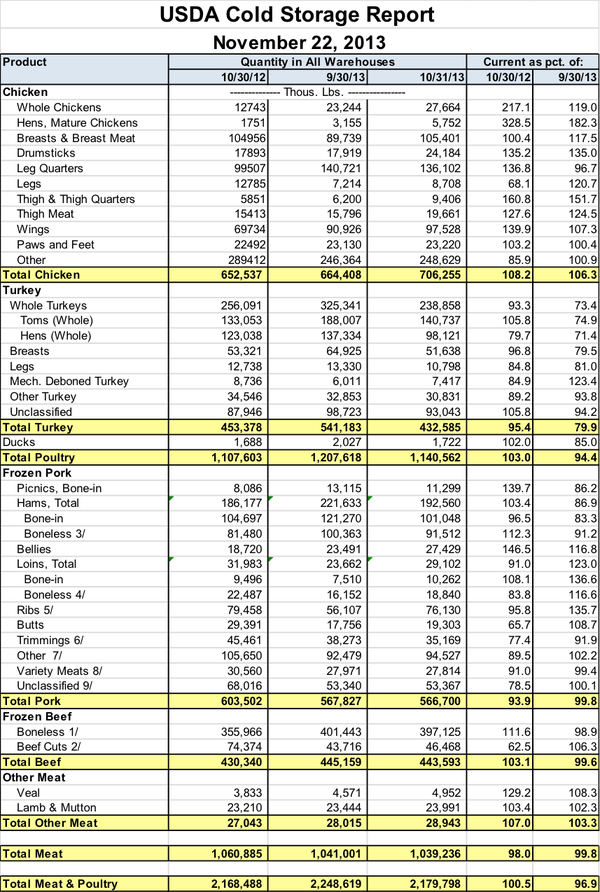

October 31 stocks of frozen meat and poultry were virtually unchanged from one year ago and were down 3.1% from Sept. 31. Pork led the decline with frozen pork inventories declining 6.1% from last year and 0.2% from Sept. 30. The October decline is unusual and a reflection of lower-than-expected September slaughter. We expect stocks to grow in November but by a smaller-than-normal amount, leaving pork inventories at a good level once the fall run is over. Ham inventories remained larger than last year but were down 13% for the month. “Unclassified” and “Other” pork categories were the largest tonnage contributors to October’s year-on-year decline with butts and trimmings not far behind. Bellies inventories were up sharply from last year’s very low level.

Chicken Concerns

Chicken stocks are a bit of a concern, with total chicken inventories being 8.2% larger than last year, and 6.3% larger than last month, just as the industry appears to be moving into full-fledged expansion. Breast meat inventories increased by 17.5% in October, suggesting some very competitive prices this fall.

Keep the most in-depth pork production information available at your fingertips! Download our Blueprint app today.

About the Author(s)

You May Also Like