Argentina’s reopening to U.S. pork, for the first time since 1992, comes at a time when U.S. pork exports to South America are on a record-breaking pace.

September 6, 2017

By U.S. Meat Export Federation Staff

The White House recently announced that the United States and Argentina have reached an agreement that will allow U.S. pork to be exported to Argentina for the first time since 1992. Though no exact timeline has been established, the market is expected to open once Argentine officials have completed an audit of the U.S. meat inspection system. The USDA Food Safety and Inspection Service must also outline export requirements for U.S. pork destined for Argentina.

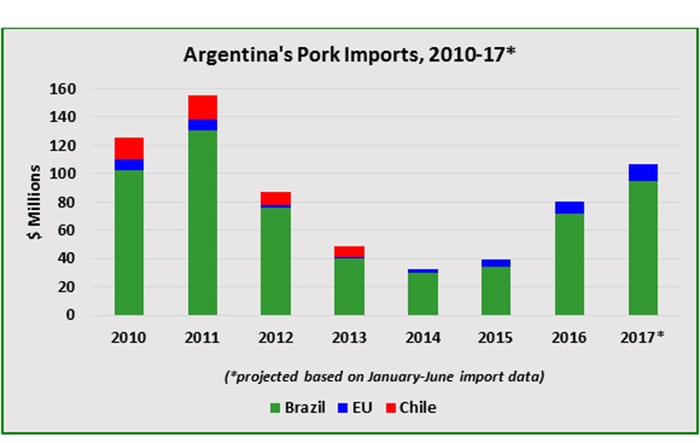

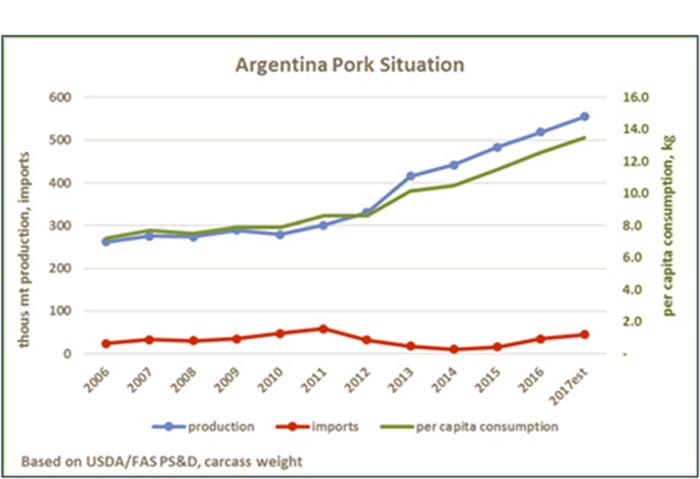

Brazil is currently Argentina’s primary supplier of imported pork, and will likely export about 32,000 metric tons of pork to Argentina this year, valued at about $95 million. Argentina is more than 90% self-sufficient in pork production but based on past experience the Argentine pork market has room for further import growth, as imports were as high as 47,000 mt in 2011.

After importing very low volumes from 2012 through 2015, imports rebounded last year to nearly 27,000 mt. Brazil captured more than 90% of the market, with the remainder provided by European suppliers (mainly frozen pork from Denmark and cured products from Spain and Italy). This upward trend in imports continued in the first half of 2017, as Argentina’s imports through June were up 79% year-over-year in volume (18,191 mt) and more than doubled in value ($58 million, up 104%).

“U.S. pork will be competing primarily with Brazilian and domestic product,” says U.S. Meat Export Federation Economist Erin Borror. “Brazil is well-positioned to remain Argentina’s primary supplier of imported pork because of tariff preferences, geographic proximity and established supply relationships, but the U.S. has an opportunity to capture a portion of the market and to capitalize on Argentina’s growing appetite for pork.”

Argentina’s per capita pork consumption has expanded rapidly over the past several years, increasing 57% since 2011 to an estimated 13.5 kilograms this year (carcass weight equivalent), based on USDA estimates. This compares to beef consumption of 56.7 kilograms and poultry at 43.9 kilograms, but beef consumption is well off its highs of the early 2000s and poultry consumption has increased only 18% since 2011. USMEF anticipates most of the demand for U.S. pork will be for raw material — including hams, picnics and trimmings — for further processing, but there are also potential opportunities for U.S.-produced processed products. Because the United States and Argentina do not have a free trade agreement, U.S. pork will be subject to a 10% import duty and 16% for processed products, compared to zero tariffs on Brazilian pork products.

Argentina’s reopening comes at a time when U.S. pork exports to South America are on a record-breaking pace. Colombia is the region’s largest destination for U.S. pork, with 2017 exports through June totaling 30,426 mt valued at $70.1 million — up 86% and 96%, respectively, compared to the first half of 2016. Exports to Chile have also thrived this year, with first-half totals more than tripling in volume (14,416 mt up 202%) and increasing 179% in value ($40.7 million) from a year ago. First-half exports to Peru doubled in volume to 2,680 mt and nearly doubled in value ($6.2 million, up 97%). Other South American markets open to U.S. pork are Ecuador and Uruguay, which combined to account for 459 mt valued at $1.6 million in the first half of this year.

“Argentina will be a positive addition to the U.S. export portfolio, providing another option for U.S. exporters serving the region,” says Jessica Julca, USMEF South America representative. “USMEF is still exploring specific opportunities in the market, but we know that Argentines have a strong preference for high-quality red meat. U.S. pork can certainly contribute to Argentina’s growing pork consumption, with plenty of product options for the grill.”

Data sources: USDA and Global Trade Atlas

You May Also Like