April 14, 2014

Last week’s news that Quality Meat Packers and an affiliate enterprise, Toronto Abattoirs, filed “Notices of Intention” to submit proposals for re-organization under Canada’s Bankruptcy and Insolvency Act sent shockwaves through Canada’s – and especially Ontario’s – pork industry. I clearly do not know much about Canadian bankruptcy law (or, thankfully, U.S. bankruptcy law for that matter!) but it appears this is the first step in the company entering bankruptcy protection from its creditors.

According to Kevin Grier of the George Morris Centre in his weekly Canadian Pork Market Review, some Ontario producers are taking issue with the notice and asked a judge to appoint a receiver over Quality’s inventory in order to pay them for hogs they delivered between March 27 and April 3. The judge denied the group’s request, meaning the notice process would proceed, thus allowing Quality to file a reorganization proposal. Grier writes that, “The obvious concern by producers over the next few weeks until the restructure period is over is whether they will get paid for the pigs they shipped.” An April 9 report filed with a court trustee indicates that Quality owed hog producers about CA$8.671 million. Ontario Pork filed evidence that 82 hog producers had shipped about CA$1 million worth of hogs during the week preceding the filing.

Grier correctly points out that the longer-term concerns will be hog and pork markets without Quality. He noted that the Toronto plant has been operating only four days per week for the past several months – a fact he has frequently discussed in CPMR. Those four days of operations likely accounted for 25,000 of the roughly 80,000 head of Ontario’s weekly federally inspected slaughter. Grier believes 17,000 or so of those hogs could go to Canadian plants and that others may flow to Tyson in the U.S. That could indeed be true this summer as Tyson’s Logansport, IN, plant begins to deal with porcine epidemic diarrhea virus (PEDV)-driven reductions in pig numbers in the eastern Cornbelt.

The impact on competition may be small since Quality owns a plant in Mitchell, Ontario, that is still operating, leaving the same number of bidders in the Ontario market. To keep the impact small, the planned expansion at the Mitchell plant needs to happen, and I wouldn’t think a bankruptcy cloud would be too conducive to that.

The impact on pork supplies will be negligible as well. Grier points out that the plant accounted for about 1% of North American output, and that the hogs will be turned to pork without that plant. He adds that its closure, though, may cause some disruption for specific customers such as Costco and Loblaw.

Grier’s conclusion: “It has been a very sad and discouraging week. Producers’ customer trust has been either wrecked or seriously hurt going forward.”

So is this a story that could be repeated in the U.S. as PEDV pig losses begin to seriously impact hog supplies? If the March Hogs and Pigs report is right, there won’t be much of a shortage. If my calculations prove correct, the shortages could be quite large. But I don’t see this costing us a plant or a firm – YET.

So far, U.S. producers and packers are treating this as a transient issue – one that is serious, but that will be resolved. Packers will run reduced hours to try to satisfy good customers, keep work forces intact and put as many pounds of product as they can through their fixed assets. That will all mean larger gross margins for the foreseeable future in spite of intense competition for available hog supplies.

If PEDV losses drag into a second year, then the situation may change. First, producers may look at huge profits and the obvious need for more pigs and just expand the sow herd enough to increase pig supplies. But such expansion will not be seen in hog numbers for at least 12 months or, more realistically, 18-24 months. Will packers run plants at suboptimal throughput for that long? The answer probably lies in the size of those gross margins.

I think packers will continue to operate virtually all of our existing barrow and gilt capacity in hopes of a) a solution, or b) expansion. U.S. consumers would still like to eat about 50 pounds of pork per person if the price is reasonable.

And what happens then if a vaccine comes along after all of those new sows have been laid down? I hate to think about that one. In spite of my grey hair, I really can’t – and don’t want to – retire by then.

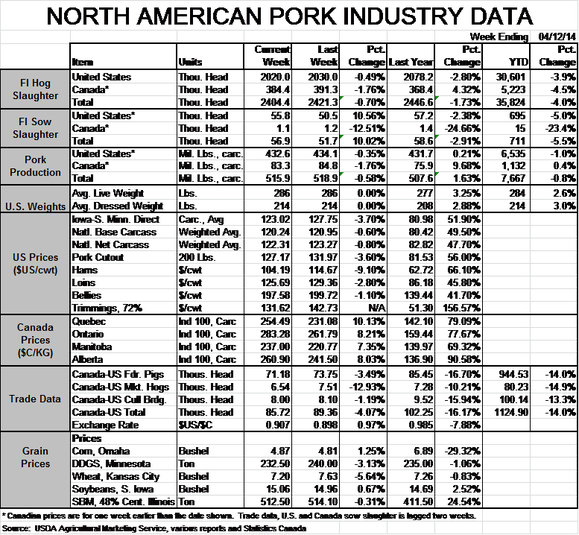

NOTE: The Canadian hog price data in today’s North American Pork Industry Data table are a week older than normal. The website at Statistics Canada was uncooperative when we tried to update the data.

You May Also Like