August 19, 2013

The past week was a set of mixed signals for the pork industry. Some good news was offset by some bad news on a number of fronts.

The Zilmax Controversy

The beef industry finds itself eyeball deep in a controversy about whether a well-researched, approved and, as far as we know, correctly-used product is causing severe lameness among feedlot cattle. In question is zilpaterol, a beta agonist and the active ingredient in Zilmax, which is sold by Merck Animal Health. Tyson announced Aug. 7 that it would stop taking Zilmax-fed cattle on Sept. 6. The other major packers did not follow Tyson’s lead, but some statements indicated they were watching cattle closely for signs of lameness. The Tyson decisions came after (but were not, to my knowledge, related to) a contentious meeting on beta agonists held during the National Cattleman’s Beef Association summer meeting in Denver. That meeting included some video from JBS Swift that showed some cattle with significant mobility problems. Merck stood by its product, but announced an effort to form a panel of experts to review its use and “re-certify” Zilmax users. Then, on Friday, Merck suspended sales of the product pending the review. No timetable for lifting the suspension was included.

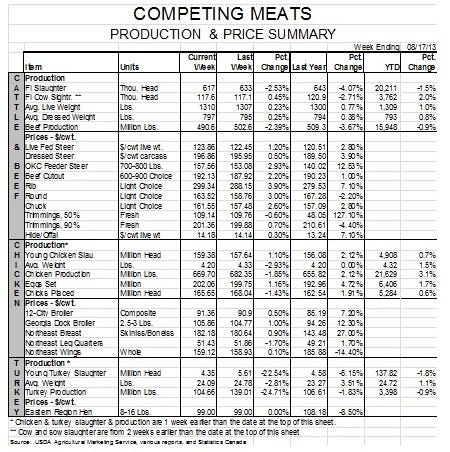

Zilmax and Optaflexx, the cattle version of ractopamine (the active ingredient in Paylean), were primary drivers in a sharp increase in cattle weights last year. Average steer weights increase by nearly 20 lb. beginning in February 2012 and those high weights are still prevalent. Removing both products would cause a sharp reduction in weight. I expect most cattle feeders to simply switch to Optaflexx, in which case weights might decline 6-8 lb. on the 70-80% of cattle fed beta agonists. That would imply a supply impact of 1%, probably beginning in late September or October.

Fortunately, neither pigs nor pork have been painted with the negative paint brush. At least not yet. The same is true, it seems, for ractompamine. But the larger issue will be whether the fact that a product is well-researched and approved by regulatory bodies is sufficient to protect its usage. The ultimate responsibility for our animals’ well-being eventually falls upon us – regardless of what products we are using to raise them.

Positive news for pork demand

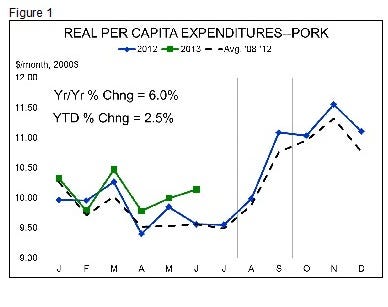

The June export data, release on Aug. 7, provided the last numbers needed to compute the demand situations for meat and poultry and the news was very good, indeed. Consumer-level real per capita expenditures (RPCE) for pork were up 6% from one year earlier, bringing year-to-date RPCE for pork to $60.51 (in year 2000 dollars), 2.5% higher than last year’s total and 3.2% higher than the average for January through June over the past five years. The RPCE increase was driven by growth in both real price (+2.7%, yr/yr) and per capita pork consumption/disappearance (+3.2%, yr/yr).

The June increase was a bit unusual as retail level expenditures are usually constant from May through July. But this year the growth has been steady (see Figure 1), and I would not be surprised at all to see it continue given what the cutout value and hog prices have done this summer. Real per capita expenditures for beef and chicken were up 2.1% and 4.2%, respectively, in June from their 2012 levels. Turkey RPCE continued to struggle vs. 2012’s excellent levels, falling 4.3% in June vs. one year ago.

Trouble for feed costs

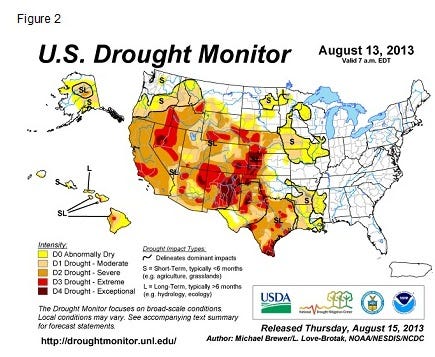

But with the positive demand news comes rising concern over costs. Continued dry conditions in Missouri, Iowa, Illinois and Nebraska have both the corn and soybean markets on edge. Add in last week’s USDA Farm Service Agency report that shows significant and larger-than-expected prevented plantings for both corn and beans and some predictions of early (mid-September!!!) frost and it is easy to see why corn and soybean futures have risen sharply. New crop corn futures are still below $5.00 per bushel, though, and projected 2014 costs, based on my model taken from Iowa State University’s historical costs and returns series for farrow-to-finish hog operations, are still right at $80/cwt carcass, over $14/cwt better than this year. Though profit potential is not as good as it was just a few weeks ago, it is still vastly better than anything producers have seen since 2010. Unless the corn and bean crops turn very, very bad, I still expect significant expansion this fall.

You May Also Like