USDA’s quarterly Hogs and Pigs Report released on Friday confirmed that the U.S. swine herd has likely begun to shrink, although the pace of that reduction is still in question.

October 1, 2012

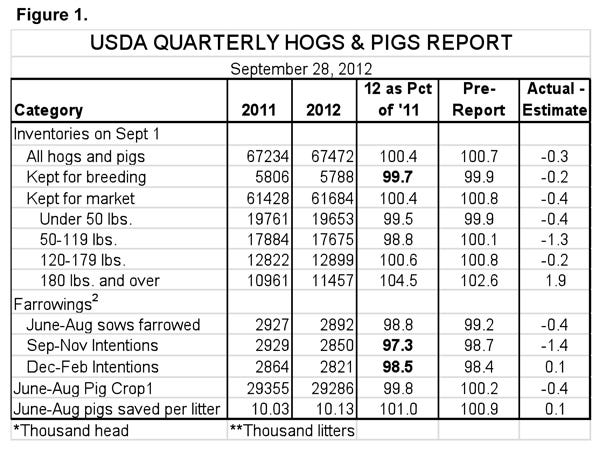

USDA’s quarterly Hogs and Pigs Report released on Friday confirmed that the U.S. swine herd has likely begun to shrink, although the pace of that reduction is still in question. The key national data from the report appear in Figure 1. Report highlights and implications are:

· A breeding herd of 5.788 million head, 0.3% smaller than one year ago, puts the Sept. 1 herd in a tie for the fourth lowest ever. That number is slightly smaller than analysts had expected and represents a 74,000-head reduction from the June 1 figure. I had commented that the June 1 number was wrong by the time it was published in late June due to the rapid increase of corn prices as drought conditions spread. This reduction, though, looks large in light of sow and gilt slaughter data, which would suggest a decline of only 55,000 to 60,000 head. Still, the direction is downward. I think the direction will continue and the magnitude may grow, especially given Friday’s Grain Stocks report (see below).

· The market herd is still slightly larger than last year but, according to USDA, all of that increase is accounted for by pigs weighing 120 lb. and more and most of it is accounted for by those weighing 180 lb. and more. The 4.5% increase in the 180-lb.-plus category agrees reasonably well with June slaughter that was up 5.5% through Thursday of last week. But it looks a bit contrived since it doesn’t fit with other categories or the March-May pig crop, which was not revised in Friday’s report. If the pigs slaughtered in September did not weigh more than 180 lb. on Sept. 1, then there may not be as many of the 120-179-lb. category pigs remaining to be slaughtered now. This implies that reports may be lower-than-expected at some point this fall.

· Farrowing intentions for Sept.-Nov. and even Dec.-Feb. look low relative to the breeding herd. June-Aug. farrowings ended up at 2.892 million litters, 98.8% of last year’s level. That figure is 35,000 larger than the expectations published in the June report. This recent patter of expectations being lower than the final farrowing numbers suggest that Sept.-Nov. farrowings may end up higher than the expectations in this report. But this summer’s heat may well have resulted in lower conception rates, leaving the 97.3% of 2011 levels as a reasonable number.

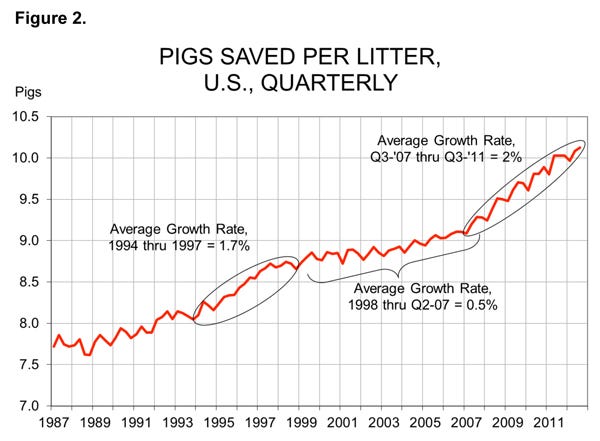

· The June-August pig crop of 29.286 million head fits well with June-Aug. farrowings and the increase in litter size (more accurately the number of pigs saved per litter) to another new record of 10.13 pigs/sow. The 1% year-on-year growth of litter size is obviously slower than the 2% per year trend of 2007-2011 (Figure 2), but the past two quarters’ lower observed increases are still not enough, in my opinion, to declare that a new trend is in place. High costs and liquidation will likely enhance litter sizes again by making higher efficiency more necessary for producers to remain profitable.

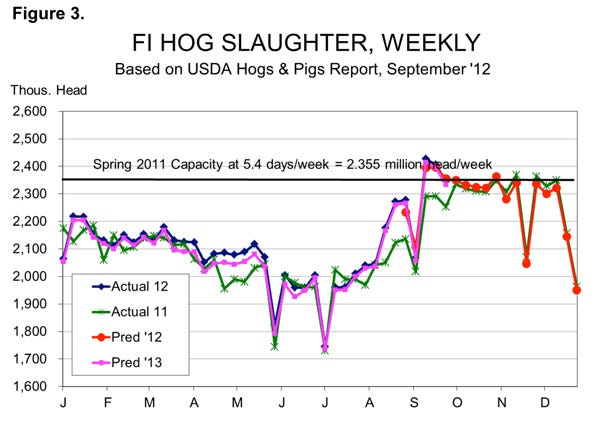

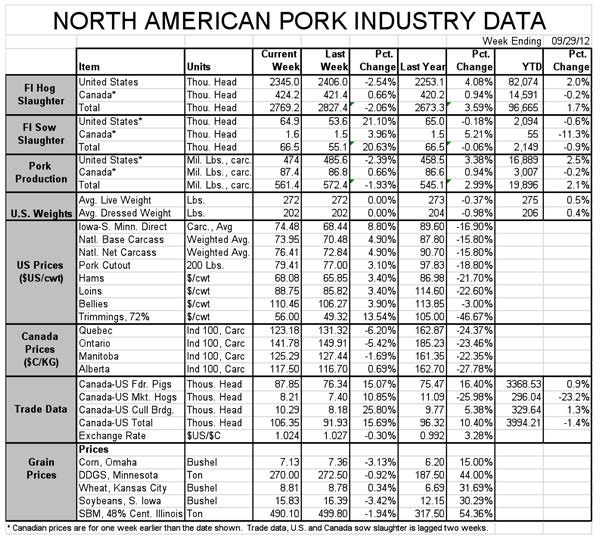

The bottom line of the report is that hog supplies are now expected to decline slightly over the next four quarters. My figures suggest daily hog slaughter this fall will run 0.3% lower than last year. That would put the Q4 slaughter figure about 1.2% higher than in 2011, given that there is one more slaughter day in this year’s fourth quarter. The data imply daily slaughter next year that is 0.7%, 1.5% and 0.5% lower, respectively, in the first three quarters relative to 2012. Q1 and Q2 both have one less slaughter day next year, though, putting quarterly slaughter totals down roughly 2%, 3% and 0.5%, respectively.

Those lower slaughter figures for Q1 and Q3 should provide some strength for hog prices, though prices will be in the mid- to upper-$70s/cwt., carcass, this fall with a few touching $80, perhaps. We should see improvement in the New Year. First quarter net prices for producer-sold pigs will average from $81 to $84/cwt. and the summer months will likely see some hogs over $100/cwt., with the quarterly averages being in the $95 to $99 range.

The trouble, of course, is that those prices still will not be profitable for most producers. USDA’s Grain Stocks report, also released Friday, shaved nearly 100 million bushels off year-end corn stocks, causing corn futures to increase the limit or nearly the limit through May.

Watch for the WASDE Report

And this situation could get worse when USDA’s October World Agricultural Supply and Demand Estimates(WASDE) report is released on Oct. 11. Recall that USDA left harvested acres alone in the September report. I don’t think they will do that again given the breadth of anecdotal evidence that many acres of corn were chopped for silage this year. If that happens, the 2012 crop will probably decline and, combined with lower beginning stocks, 2012-13 usage will have to be trimmed again.

About the Author(s)

You May Also Like