Moderate growth in sow herd, average litter size would test weekly limits.

June 15, 2013

One year ago, it appeared that packing capacity would become a real issue in the fall of 2013. The concern was well-founded, as producers were expanding the breeding herd by roughly 1% and average litter size was growing at a rate of about 2% per year. The combination suggested that U.S. hog slaughter could grow by more than 3%, year on year, by late 2013.

With hog slaughter already headed toward a new quarterly record of 30.433 million head in fourth-quarter 2013, the prospect of pushing 3% more hogs through the current packing sector looked daunting.

Then the worst drought in 50 years came knocking. Plans to grow the breeding herd and improve litter size slowed. Slaughter levels in fourth-quarter 2013 will likely be lower than last year. But questions about packer capacity loom.

Daily Capacities

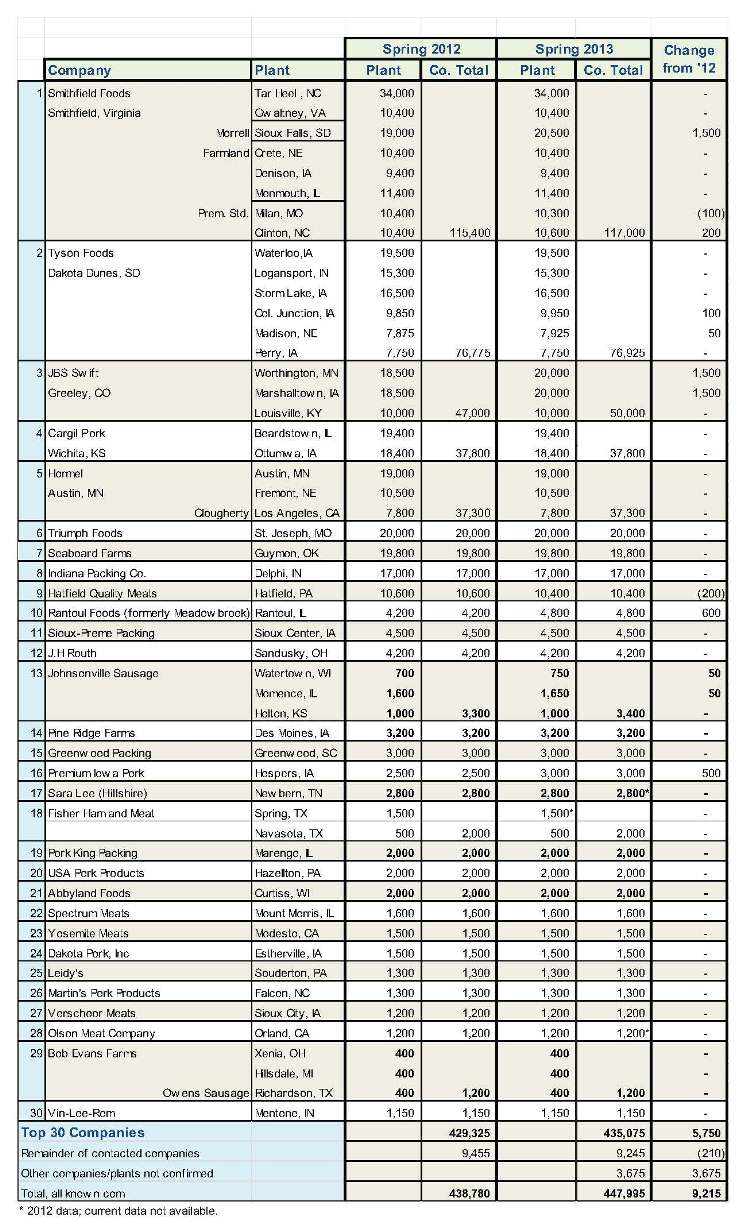

The table at the bottom of the story shows the results of this year’s survey of U.S. pork packers with daily capacities of 1,000 head and more. Each company was polled in April or May, asking for its daily slaughter on a “normal day,” and assuming hogs are plentiful and margins are good.

The capacity-limiting factor varies from plant to plant. Some are limited by cooler space. Others will slaughter only as many as they can process in a similar amount of time. Plants with more than roughly 11,000 head/day have capacity to run two shifts.

Daily slaughter counts were updated for all plants except the three that did not respond to the survey. Those are listed at 2012 levels.

There have been no significant changes in daily capacity in the past 12 months. The largest increases were 1,500 head/day at Smithfield’s Sioux Falls, SD, (John Morrell) plant and at the JBS Swift plants in Worthington, MN, and Marshalltown, IA. Rantoul Foods, which began operations in the former Meadowbrook Farms plant in Rantoul, IL, in 2012, increased its capacity by 600 head/day, while Premium Iowa Pork, a division of Lynch Livestock, increased throughput at its Hospers, IA, plant by 500 head/day.

The total increase at the 29 surveyed companies was 5,750 head/day — a 1.3% increase. The 1,000-head-plus plants account for 97% of total U.S. slaughter capacity.

In past surveys, we have included another 27 plants with daily capacities of between 100 and 1,000 head/day. Their total capacity is estimated at 9,245 head/day. The only change we know of in that group is the loss of Avco’s Gadsden, AL, plant to fire. In 2011, the plant’s daily capacity was 210 head/day.

Tracking hog slaughter plants is a challenge. State-inspected plants do not appear in lists of facilities subject to federal inspection. Old plants sometimes get reopened and others seemingly fly under the radar. A knowledgeable industry source provided the names of 12 additional firms operating plants in nine states. We were unable to contact these firms by press time, but our source estimates that they provide another 3,600 head/day of total capacity.

The total for the plants we have always tracked stands at 444,320 head/day — 5,540 head, or 1.3%, higher than last year. When we include the estimated capacity of the unconfirmed plants, total U.S. capacity is 447,995 head/day.

Weekly Capacity

Logic would suggest that weekly capacity is six times daily capacity. Some plants do not operate on Saturdays. Others add Saturday shifts only when margins and supplies dictate it.

Average Saturday slaughter in 2012 was 123,644 head, or about 28% of total capacity, compared to 20% in 2010 and 23% in 2011.

Viewed another way, the U.S. pork packing sector operated roughly 5.28 days/week in 2012, on average. If packers operated at that level in 2013, it would mean the sector could handle an average of 2.365 million head/week. In my experience, the sector can run at 5.4 to 5.5 days per week for an extended period of time, meaning that the practical top would be 2.419 to 2.464 million head. The peak weekly total for 2012 was 2.427 million.

Based on USDA’s March Hogs and Pigs report and some revision of 2012 weekly slaughter data to reflect a more normal seasonal marketing pattern, the highest weekly total in my forecasts for this fall is 2.357 million head, well within the sector’s capability.

My greatest concern is next year, and also, especially, 2015. Normal corn and soybean crops this fall will put breakeven costs at or below $80/cwt., carcass. Current Lean Hogs futures prices indicate sufficient profits at those costs to drive some expansion of the sow herd.

If the industry adds 2% to 3% more sows and average litter size continues its 1.5% upward trend, we could expect 3.5% to 4.5% more pigs by fall 2014. That would put the maximum weekly total at 2.44 to 2.46 million head, very close to the current capacity estimate. Another year of that kind of growth would put supplies beyond the capacity to comfortably process them, likely pushing packer margins higher and hog prices lower.

Marginal Changes Ahead

There is little help on the horizon. Triumph Foods is the only company with definite plans to expand, but its plan to add a plant in East Moline, IL, is on hold, indefinitely.

Hormel Foods has talked about expanding its Fremont, NE, plant to accommodate two shifts, but no concrete plans have been announced. Tyson Foods has indicated it would like to run a double shift in its Madison, NE, facility, too.

The bottom line is that capacity gains will come from marginal changes in chain speed and operating capacity. Producers need to realize that as they make production plans for the future.

You might also like:

Expect Corn Projections to be Dialed Back

You May Also Like