May 21, 2012

There have been times this spring, especially during the lean finely textured beef/beef trimmings debacle, when pork and hog demand have seemed less than stellar. But the past few weeks’ data suggest that ample pork supplies are keeping markets under plenty of pressure. The data tables at the end of this column reinforce that observation; they are an extension of the past couple of months.

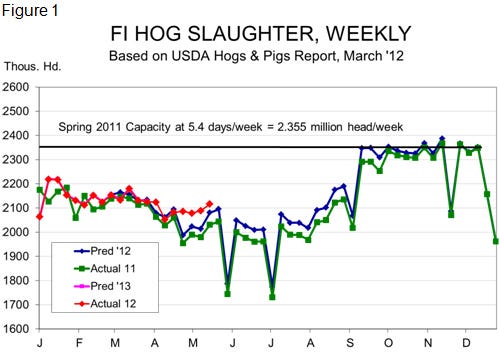

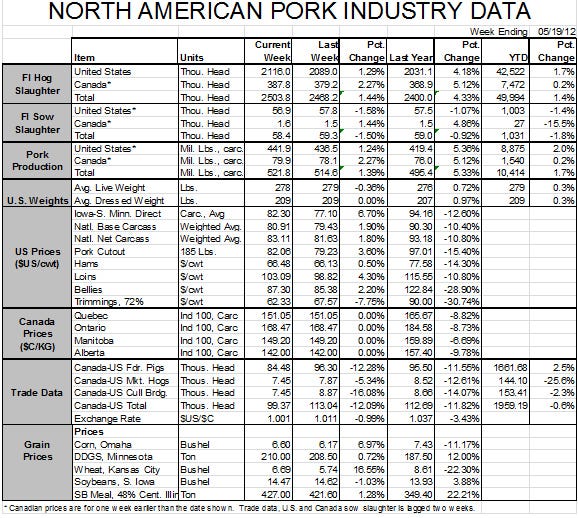

U.S. federally-inspected (FI) slaughter topped 2.1 million head last week, ending up at 2.116 million head, 1.3% higher than the previous week and 4.2% higher than last year (Figure 1). That figure is closer to the level I expected based on the March Hogs and Pigs report (2.081 million head) vs. what we have seen the last three weeks. But it is still 1.8% higher than the predicted level and the total of the past seven weeks (a period chosen to include Easter week in both 2011 and 2012) has seen FI slaughter 3.7% larger than last year and 2% larger than indicated by the March report.

The table shows that weights last week were 1% higher than last year, but the barrows and gilts reported under the mandatory price reporting systems were even a bit heavier. Carcasses have averaged 1.1% higher than last year since April 8. These hogs represent 95% or so of the “butcher hog” supply.

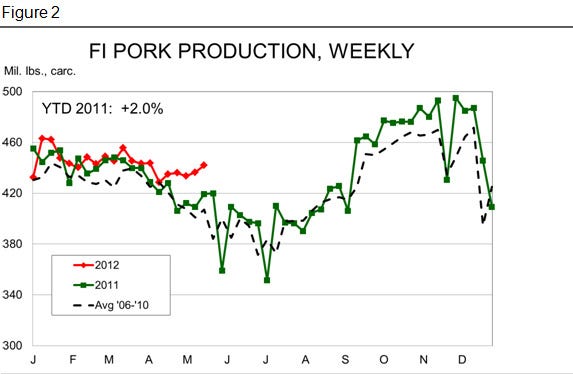

Add it up and last week’s FI pork production was up 5.4% from 2011. Compare the past seven weeks and that number is 4.5%. Production so far in 2012 is 2% larger than last year (Figure 2).

Suffice it to say that any slippage due to summer heat or porcine reproductive and respiratory syndrome (PRRS) holes are not apparent yet. The time is probably past for a heat-induced reduction in numbers. PRRS losses could, conceivably, still show up.

This winter’s excellent performance (according to anecdotal close-out data) could have pulled some summer marketings forward, but I have hardly ever seen that show up in lower hog numbers unless we run into some severe hot weather that slows growth rates. That could certainly happen, too. It did last year. For now, it appears that we simply have more hogs and heavier hogs available. The percentage change figures for hog supplies and hog prices in the data table point to one culprit at present – ample pork supplies.

Propped Up by Beef, Chicken

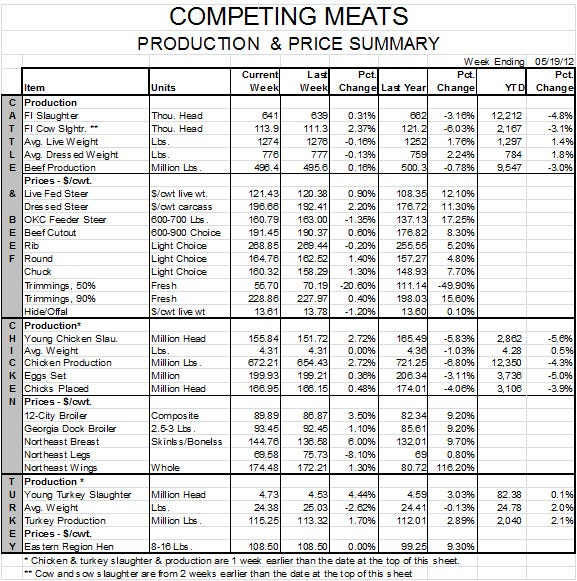

Pork demand should be helped, though, by a rebounding beef market. The Choice beef cutout averaged $191.45 last week, up $1.08 for the week but nearly $14/cwt. higher than for the week of April 13. That week was the bottom of the post-“pink slime” swoon and represented more than a $20/cwt. drop from the record-high $198.51 set the week of March 2. Further, Live Cattle futures have gained $6 to $8/cwt. in the past week and Friday’s Cattle-on-Feed report showed the first year-on-year decline in feedlot inventories in two years.

Feedyard placements in April were nearly 15% smaller than a year ago owing to tight feeder cattle supplies and resulting high placement costs as well as abysmal forward margins. Those placements should have been bullish, but it appears that bullish sentiment was already in the market after last week’s rally as Live Cattle futures are marginally lower in Monday morning trading. I still expect $200 Choice beef and cattle near or, perhaps, slightly above $130 yet this year. The resulting higher retail beef prices will help pork demand.

Chicken prices have also remained supportive to pork demand with whole broiler prices nearly 10% higher than last year. Even breast meat moved above $144/cwt. last week to +9.7% from last year. Lower slaughter levels were established by a smaller layer flock months ago and lower egg sets and chick placements weeks ago. The sets and placements were still 3.1% and 4.1% lower, respectively, than last year the week that ended May 13, an indication that the cutbacks will remain for at least a few more months.

Feed Cost Vulnerability

But what happened to those lower feed costs that I discussed last week? Some dry conditions in the winter wheat belt and just a hint of dryness in the Corn Belt have sent grain futures skyward this week. The rally in corn underscores my contention that acres are great, but this crop is still going to be all about yield.

A yield equal to last year’s (147.2 bu./acre) and usage equal to USDA’s April estimate of this year’s usage (it is not fair to use USDA’s estimate of 2012-13 usage since it is based on a 14.8-billion bushel crop and prices in the mid-$4.00 range) would leave carryout stocks barely above 1 billion bushels. That is less than 200 million bushels higher than this year’s projected 851 million. It would leave the stocks-to-use ratio at 8.1%, higher than this year’s projected 6.3%, but still the third-lowest ever. We must have adequate and timely rains for feed costs to be significantly lower in 2013.

About the Author(s)

You May Also Like