High Hog Prices Come with Complicated Consequences and a Positive Export Picture

March 10, 2014

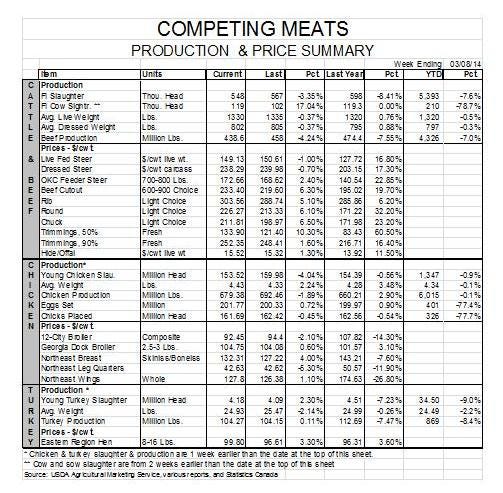

Amid the porcine epidemic diarrhea virus (PEDV)-driven pig losses, there is some good news for U.S. pork producers. First, prices and profit potential are both record high. Second, 2014 exports got off to a good start in January.

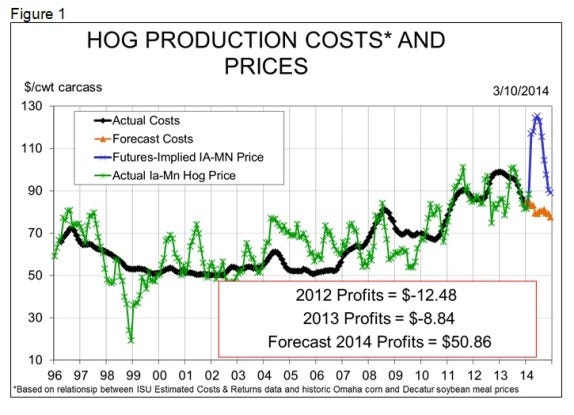

Last week’s explosion of both cash and futures prices for hogs provides some solace for producers who have fought PEDV this winter. While the number of hogs that producers will sell has certainly declined, the prices of all of the remaining supply have risen by about $20/cwt. carcass since February 1. In fact, our model of farrow-to-finish costs and returns, which is based on Iowa State University’s parameters, now indicates that 2014 profits will average over $50 per head, an all-time record.

There are a couple of significant caveats for that figure and for Figure 1, however. First is the obvious fact that producers impacted by PEDV will not have nearly as many pigs to sell. Further, some of those production voids are going to occur this summer when profit margins are currently expected to exceed $90 per head. But for those producers that have avoided PEDV or have seen minimal death loss, 2014 will be a once-in-a-lifetime year. It’s good to raise crops when the drought strikes elsewhere, right?

The second caveat is that many producers will not benefit from these record-high summer markets because they had already locked in hogs at or near record-high values back in January and early February. “Manage the margin” has been the mantra for many – including me! – since costs became a source of significant risk back in 2007. “When margins are near the top of the historical distribution, lock some in!” has been my advice for some time. Still is.

The trouble arises when “near the historical high” becomes low due to an unprecedented run in prices. The prudent producers who took advantage of those $40 or so margins for this summer are now coughing up huge margin calls to cover the potential losses on those futures positions. The good news, of course, is that – provided the positions are true hedges that are offset by a long position in physical hogs – higher cash prices will offset those losses as long as there are cash hogs to be sold. I do not recall a time in my career where hog producers have faced a crop failure but that is indeed what producers face for 3- to 4-week periods this spring and summer.

Like what you’re reading? Subscribe to the National Hog Farmer Weekly Preview newsletter and get the latest news delivered right to your inbox every week!

Basis levels complicate the scenario as well, but do not let today’s basis situation color your viewpoint too much. Non-spot months are the worst for hog basis simply because the cash-settled Lean Hogs contract must converge only in the last few days of a contract’s life. Spot month basises are not much, if any, larger than those that prevailed for the pre-1996 deliverable live hog contract. But they can be large in the non-spot months such as March, especially when futures markets make a huge move.

A growing concern is the amount of capital those margin-based credit lines are requiring. I would argue margin loans are among the safest that a banker can make as long as the producer and the banker stick with them until the cash sale is made. But those loans have put significant debt on producers’ balance sheets and some of those balance sheets may not have been terribly strong after losses in 2012 and 2013. They can also put the capital positions of banks in a bind. We know of no problems, but the possibility exists if a bank has a large exposure to pork production loans.

It’s amazing -- and a little depressing – how such HIGH hog prices can cause so many problems!

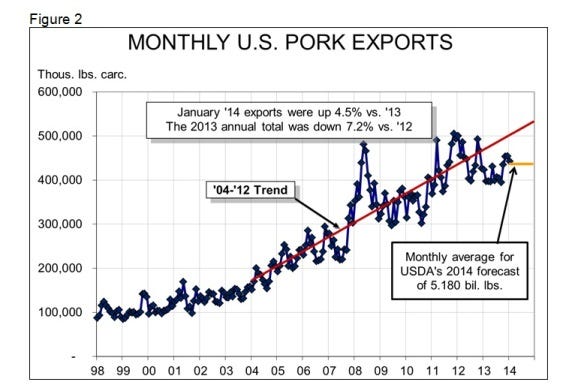

But let’s talk about an unquestionable positive: January exports. Total U.S. pork exports grew by 4.5% from January of last year. The value of those exports rose by 4% as well. The higher prices of February and expected much-higher prices in coming months may put some pressure on exports, but January was good. See Figure 2.

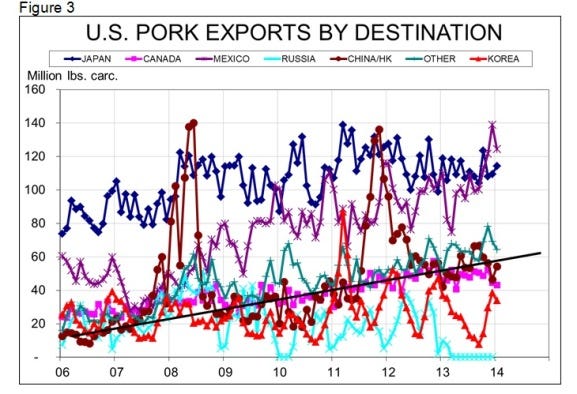

As for individual customer countries, the story continues to be Mexico. For the third straight month, Mexico was the number one destination for U.S. pork. Both Mexico and China/Hong Kong have surpassed Japan as the top market for two straight months, but this is the first time that anyone has hit a string of three. Japan is still a strong second and “Other” markets – with Colombia and Australia leading the way—remain number three. I plan to break out some of those markets from next month’s data given their rising importance. Shipments to China/Hong Kong rebounded from December’s disappointing level and were 29% larger than one year ago. We will be watching these figures closely for a “Smithfield/Shuanghui” impact, but PEDV losses among Smithfield’s large holdings in North Carolina and higher U.S. pork prices may cause it to be very difficult to discern.

U.S. pork variety meat exports were down 2.5% in volume and 3.3% in value from last year’s levels.

You might also like:

Large Reductions Estimated in Hog Supply Due to PEDV

Total Born for First Parity Females Drives Future Production

Despite PEDV and Other Challenges, Pork Producers Remain Upbeat on Future of the Industry

You May Also Like