Global pork export volume down slightly in ’17; value sets new record

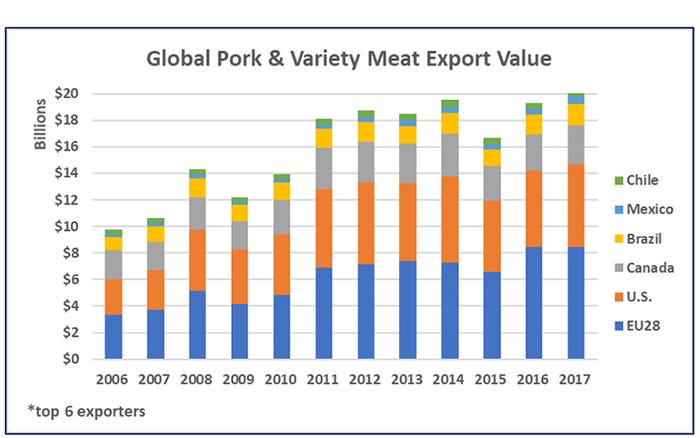

Export value set a new record in 2017 of about $20.23 billion, up 5% year-over-year. For the world’s top six exporters, export value has more than doubled since 2006.

March 7, 2018

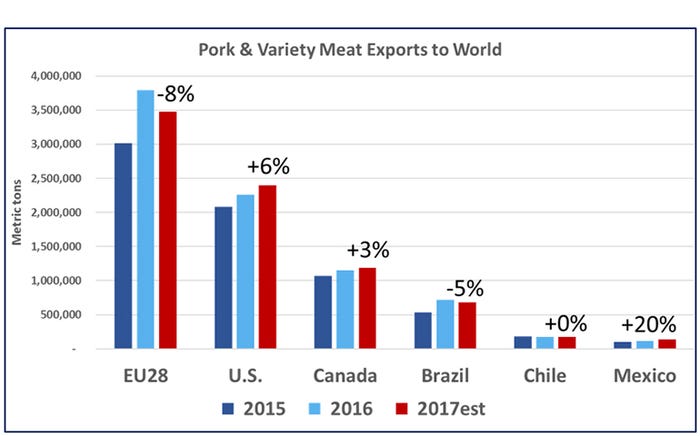

When complete 2017 trade data are available, global pork exports will likely be about 2% lower than the record volume achieved in 2016 — which was driven in part by soaring demand from China. Exports from the world’s six leading suppliers (the European Union, the United States, Canada, Brazil, Chile and Mexico) totaled 8.065 million metric tons, falling 2% year-over-year after a remarkable 18% increase in 2016. Export value set a new record in 2017 of about $20.23 billion, up 5% year-over-year. For the world’s top six exporters, export value has more than doubled since 2006.

China’s imports cooled last year (down 17%), but still reached the second-highest volume on record at 2.45 million mt (up 58% compared to 2015). Global demand for pork remained impressive as growth in other import markets — both established and emerging — helped offset the decline in China.

The United States led global pork export growth with a 6% increase to 2.45 million mt, while export value climbed 9% to $6.49 billion. For a full summary of the 2017 export results for U.S. pork, see this U.S. Meat Export Federation news release.

EU pork exports had a strong finish to 2017, but ended the year at 3.5 million mt — down 8% from its 2016 record. Export value, however, held steady at $8.46 billion. EU exports slowed to China/Hong Kong (1.8 million mt, down 18%) but increased to the rest of the world (1.71 million mt, up 6%). This included growth to Japan (378,360 mt, up 7%), South Korea (267,396 mt, up 5%), the Philippines (198,409 mt, up 13%), the United States (142,092 mt, up 30%), Taiwan (58,799 mt, up 28%), Ivory Coast (49,913 mt, up 21%), South Africa (32,381 mt, up 15%), Serbia (31,203 mt, up 22%) and Congo (29,259 mt, up 30%).

For muscle cuts only, EU exports were down 9% in 2017 to 2.2 million mt, as a sharp decline to China/Hong Kong (863,070 mt, down 23%) was not fully offset by an increase to the rest of the world (1.33 million mt, up 5%). EU hog prices have been slightly higher than in the United States in 2018 and this was also the case for most of 2017 — but the spread between EU and U.S. export prices remains quite narrow.

Canada’s 2017 exports set another new volume record at 1.19 million mt, 3% above the previous high set in 2016. Export value was $2.98 billion, up 7% year-over-year, but below the 2014 record of $3.24 billion. Canada’s pork export growth was driven by Japan (227,994 mt, up 16%), Mexico (103,840 mt, up 2%), the Philippines (41,058 mt, up 46%), Taiwan (39,666 mt, up 93%), Chile (12,523 mt, up 16%) and New Zealand (10,357 mt, up 18%). This offset a slowdown to Canada’s top two markets: the United States (347,713 mt, down 7%) and China (303,367 mt, down 2%).

For muscle cuts only, Canada’s 2017 exports were up only slightly year-over-year to 1.02 million mt as decreases to China/Hong Kong, the United States, Mexico, Korea and Australia were only narrowly offset by growth to Japan, Taiwan, the Philippines, Chile and New Zealand.

Canada’s hog slaughter totaled 20.73 million head in 2017, up 2% year-over-year and the largest since 2009. The combined total of Canadian slaughter plus live hogs shipped to the United States increased 1% year-over-year, as U.S. imports of Canadian hogs fell 1% to 5.6 million head. So, while Canada’s pork industry is in expansion mode, it hasn’t seen the record-breaking production under way in the United States.

Brazil’s 2017 exports were down 5% from the 2016 record, totaling 680,000 mt. Due in part to a stronger Brazilian real, export value increased 10% to $1.6 billion. Export volume slowed to Hong Kong (155,000 mt, down 5%) and fell sharply to China (48,940 mt, down 44%), but was otherwise higher to most other main destinations including Argentina (32,455 mt, up 30%), Uruguay (31,021 mt, up 9%), Angola (30,256 mt, up 2%), Chile (23,416 mt, up 1%) and Georgia (11,077 mt, up 27%).

The most pressing question for the Brazilian pork industry is the future of the Russian market, where 2017 exports increased 6% to 257,460 mt, and accounted for 38% of Brazil’s total export volume. But Russia suspended imports of Brazilian pork on Dec. 1 due to the detection of beta agonist residues, and three months later the market remains closed. Unless this impasse is resolved soon, it could pose a major challenge for Brazil’s exports this year and be a source of price pressure in markets such as China/Hong Kong.

Exports of Chilean pork were down slightly in 2017 to 175,244 mt. Volumes slowed to top market China (67,187 mt, down 9%) and to Korea (26,850 mt, down 7%), while exports trended higher to Japan (28,211 mt, up 3%), Russia (17,813 mt, up 52%), Mexico (7,960 mt, up 23%) and Costa Rica (7,373 mt, up 67%). At the same time, Chile’s pork imports set another new record at 76,000 mt (up 29%), led by steep increases from the United States (27,563 mt, up 67%), Canada (13,861 mt, up 40%) and the EU (9,930 mt, up 26%), while imports from Brazil were down slightly to 24,190 mt. Chile’s pork production has not kept pace with strong demand in both the international and domestic markets.

Mexico’s 2017 export data is only available through November, but volume was up 20% year-over-year to 121,607 mt, while value climbed 21% to $498.4 million and should finish 2017 at about $545 million. Exports (through November) increased to all three of Mexico’s primary markets: Japan (89,795 mt, up 21%), the United States (13,877 mt, up 16%) and Korea (13,777 mt, up 8%).

Japan’s 2017 pork imports reached a record 1.16 million mt, up 8% year-over-year, valued at $5.17 billion (up 6%). Chilled imports were up 12% to a record 398,849 mt, led by a 27% increase from Canada. On a volume basis, the United States remained Japan’s largest overall supplier with 35% market share, followed by the EU with 31.5%.

Korea’s imports were also record-large at 516,572 mt, up 5% year-over-year and surpassing the disease-shortage driven volume of 2011. This time imports were driven by strong demand, with import value soaring 20% year-over-year to $1.6 billion.

Among other major importers, the Philippines took a record 291,746 mt, topping the previous year’s high by 15%. Imports entering Taiwan (95,605 mt, up 30%) and Colombia (70,807 mt, up 29%) climbed dramatically while modest increases were seen in the United States (510,350 mt, up 2%), Australia (165,341 mt, up 2%) and Singapore (102,431 mt, up 2%). Russia’s imports were up 7% year-over-year to 294,000 mt, but this is still far below the totals Russia posted earlier in this decade, which peaked at more than 890,000 mt in 2012.

Data sources: Global Trade Atlas, USDA and U.S. Meat Export Federation estimates

About the Author(s)

You May Also Like