January 26, 2015

What happened to the hog market? That was a big question on a lot of minds last week at the Minnesota Pork Congress, and will no doubt be a primary topic of discussion at this week’s Iowa Pork Congress. It is a legitimate question – to which there is not a very clear answer.

First, let me say as kindly as possible “Welcome back to the real world.” That 2014 trip off into fantasy-land was fun – except for that part with all those dead pigs in some of your farrowing units – but we are now back to reality. There are bad and good parts of that reality.

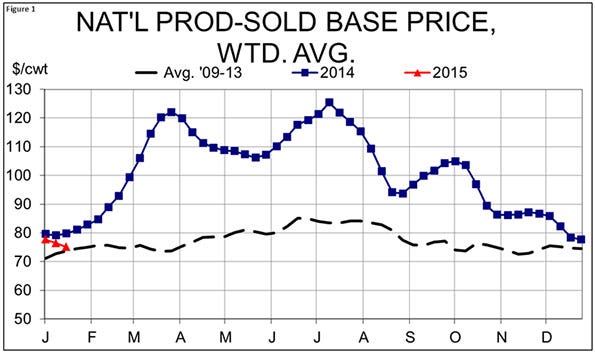

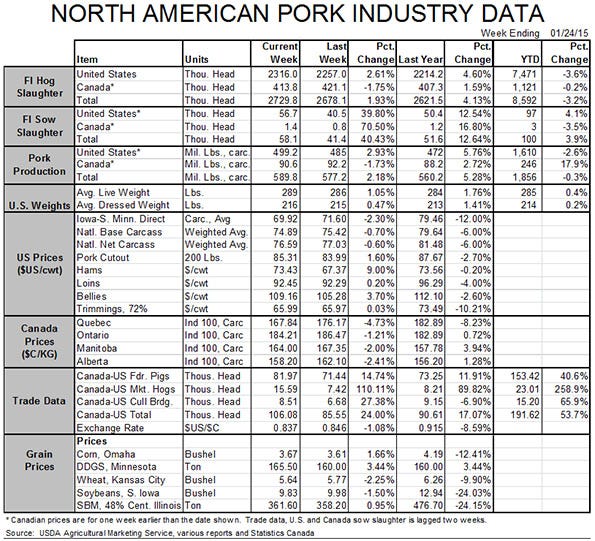

The bad, of course, is that we are no longer in rarified price air. Supplies have grown and continue to do so. Porcine reproductive and respiratory syndrome is reportedly causing some problems, but porcine epidemic diarrhea virus has been a kitten compared to last year’s lions. We’ve see this new normalcy since late-October and, if you study today’s Price and Production tables, you will see that pork production is up from one year ago and prices are down. You will also see that the price declines are, if anything, low relative to the supply increases. With more hogs on the way, we all know that prices will be lower this year.

The good part of the new normalcy is that costs remain low and will stay that way for the foreseeable future. Our model has average costs for 2015 at just over $71/cwt. carcass. The best of you will be around $65. There is no way pork producers will allow prices to exceed costs by very much for very long. Never have. Never will. But even the lower prices we are seeing are still profitable. Futures prices are getting a little too close for comfort but today’s rally has average profits near $8.50 per head for the year in our model. The best of you can tack another $10 to $12 on that. It’s not 2014 but it’s not bad.

So what has happened to cause the decline – especially in futures? In a nutshell, a bunch of negative happenings. Some merited consideration and some did not but futures traders frequently don’t stop to consider justification, especially if the trader has micro-chips for innards. Consider:

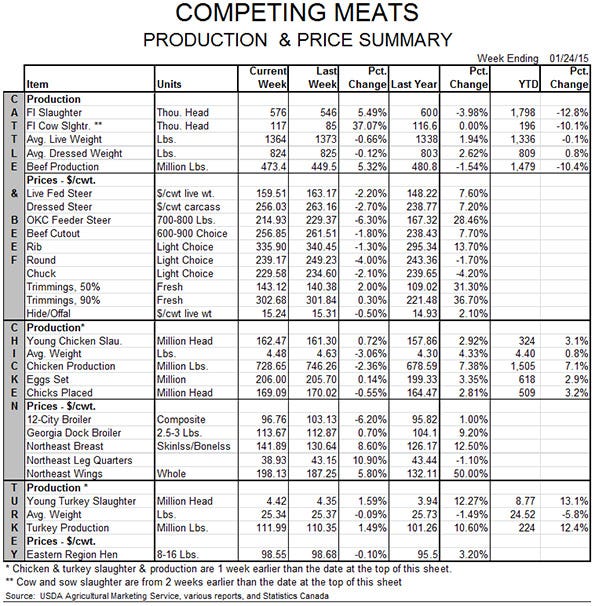

The massive selloff in feeder cattle and live cattle futures. I would argue that the best explanation for the massive decline in these prices was the massive explosion of these prices in the first place. Cattle were way out of whack with everything and, like hog production profits, that might last for a bit but it won’t last forever. That is especially true when funds are big players and these funds’ liquidation over the past month has fueled the decline. Should that have a direct impact on hogs? Not especially. But it frequently does and we’ve seen it recently.

The West Coast port situation has begun to put a pinch in product flow. These things don’t hurt much at first but the longer they go on, the more severe they get and I started hearing rumors of cancelled shipments week before last. Those rumors got numerous last week, and I suspect that we are seeing some product that was destined for China or Japan looking for a home here in North America. That’s not good for domestic prices.

The dollar has appreciated versus the CME Dollar Index by nearly 20% since July. Like the dock slowdown, the changes didn’t matter much for a while but last week’s trading put the Index above 95 for the first time since September 2003. This is more than the “flight to safety” rallies we’ve seen since the financial crisis began in 2008. The dollar is negatively related to the price of oil. Our historic position as the largest importer of oil is a major cause of that but that position is changing, too. Whatever the reason, it’s bad for exporters.

Finally, it is late-January. Post-holiday winter is frequently the dregs for pork demand, at least at the wholesale level. It’s too late for holiday hams and too early for Easter hams. The hot dog business is still months away. Though this has been a mild winter, there is just not much to push pork at this time of year. It seems like I write a “It’s February” column about every year. February seems to have arrived early.

So will this all get better? I think so. Russia announced today that it was easing import restrictions on pork from France, Hungary, Italy, Germany, Denmark and Netherlands. That will help our shipments to Asia (if we can get them loaded) where European Union pork previously headed to Russia has been competitive. Winter will give way to spring. Happens every year and things usually get better. Retail pork prices are still strong, providing some space for wholesale prices – and, in turn, hog values – to rebound. Those big downstream margins may stick in your craw but their continuation allows hog prices to recover much more easily. Finally, we have seen nothing to suggest that Americans’ rediscovery and re-acceptance of meat has waned. December trade data will be out Feb. 6 to complete the domestic demand picture for 2014, and my bet is that it will continue the positive picture already painted by the markets from January through November.

Take a deep breath and focus on what needs to be done. This year will not be last year, but I think the current situation is more dire than it should be. When the grass is green we’ll take another look but I expect the view to be better by then.

About the Author(s)

You May Also Like